Get Complete Project Material File(s) Now! »

The Logic of Business Groups: A Moral Hazard Perspective

Introduction

Since the seminal work by La Porta, Lopez-De-Silanes and Shleifer (2002), academic interest in business groups has been revived. In the past two decades, scholars have formed many theories about their formation motives. Proponents of business groups argue that they play an important role, during a catch-up phase of underdeveloped economies, where rule of law and institutions are typically weak, stifling labor, financial and product markets, which businesses are able to overcome by creating their own intragroup markets. Hence, business groups tend to be star performers during economic development due to their enhanced operational efficiencies via better integration, and lessened agency problem improving survival chance via intra-group insurances, Khanna & Yafeh (2007). Others argue that business group formation motive lies in their risk management opportunities, as they serve as shock absorbers during financial instability.

Since more creditors are impacted from a default of any individual firm or financial institution, business groups shield the rest of the system against losses, Allan & Gale, (2000), Freixas, Parigi & Rochet, (2000). On the other hand, there are also cautionary tales that reveal time inconsistencies of business groups and their formation. After successfully serving economic development the tycoons sitting at their helm, have little incentive to see their economy graduating to the developed class of economies, which would sprout increased competition, stronger institutions, rule of law and creditors rights, that will eventually weaken their own stronghold, resulting in a “middle-income trap” as coined by Morck, et al. (2005), Morck & Yeung (2014). Looking at literature from the days of the Great Depression, pyramids are formed to allow a family to achieve controls of a firm using only a small equity stake. This is particularly useful when private benefits of control are large, which suggests that business groups are a means to separate cash flow rights from voting rights, Berle and Means (1932) and Graham and Dodd (1934).

As pointed out by Almeida and Wolfenzon (2006) business groups are not needed for the that purpose, however since dual class shares will work equally well for that aim. Almeida and Wolfenzon build a theoretical model showing that as investors’ protection is imperfect, the family (or business tycoons) extracts private benefits from the firms it controls at the expense of minority shareholders. They also show the incentive of the family to continue weaving the web of a financial network of this type, as investment opportunities arise, supporting the diversification motive. Almeida and Wolfenzon’s theory of business groups speaks directly into, Johnson, La Porta, Lopez-de-Silanes and Shleifer (2000), published earlier. They show that business groups can be a product of crony capitalism, where ultimate controlling owners tunnel cash out of its weaker affiliates at the expense of minority shareholders during good times, Johnson, et al. (2000), Bertrand, Mehta & Mullainathan (2002), using them as dumpsters to spin off toxic assets during bad times, and to avoid taxes (Beuselinck and Deloof, 2014).

Due to data limitation and identification challenges, the literature is still open on why business groups are formed, their role in financial stability and excessive inequality.

This paper proposes a new perspective on the motives for business group formation: Moral hazard. We study whether expectation of government bailout made it possible for business groups to obtain cheaper and bigger loans. Once corroborated, this perspective has three important implications: 1) First of all, it suggests that group-affiliated firms’ higher profitability may also arise from cheaper financing, rather than integration-induced efficiency enhancement alone. Thus the business group model should not be emulated without acknowledging the systemic risk it imposes. 2) Secondly, while the cheaper financing can be incentive compatible for all parties involved, it can impose negative externality on taxpayers. From bankers’ perspective, lending to group-affiliated business is less risky due to its high profitability and explicit or implicit guarantee from related firms and the government; from the government’s perspective, it can be in the nation’s interest to develop strong brand presence during normal times, and when a financial crisis hit, the government has every incentive to bail out these group-affiliated firms first, to prevent or arrest the domino effect. Unfortunately, the only loser in the game is the taxpayer – for the bailout is funded directly using tax dollars, or indirectly though inflation. 3) Finally, when lending to group-affiliated firms, bankers should not be awed by a firm’s group affiliation status. Rather, they must entertain the possibility that its implicit or explicit guarantors may be unwilling or unable to bail it out, and price the risk accordingly – even if the guarantor seems infallible. Failing to do so might result in inordinate loss during a financial crisis, as we will show in the paper. Unabated credit allocation during credit boom, into concentrated ownership structures, might even bring one about.

This paper exploits an exogenous shock to Icelandic government’s willingness to bailout its economy in 2010, and study how it affected lending practices to group-affiliated firms. The rest of the paper is structured as follows: 1) We first build the textual evidence that Icelandic government’s unwillingness (or inability) to bailout its economy was truly unanticipated by all market players, and did not crystalize until March 2010; 2) Using data, we document how the exogenous shock forced bankers to absorb greater losses on lending to group-affiliated firms 3) We study how this corporate restructure experience changed bankers’ lending practices to group-affiliated firms, using annual results from OLS and FE regressions; 4) We discuss how these empirical estimates support the moral hazard perspective of business group formation. 5) We discuss alternative explanations that would also be consistent with our findings, and perform some auxiliary tests.

Bailout or No Bailout? The Icelandic Surprise

In this section, we aim to establish March 2010 as exogenous shock to bankers’ expectation of government bailout. The textual evidences are grouped into 2 sets:

1. Prior to March 2010, it was widely expected that the Icelandic government would bailout systemically important banks and subsequently carry all of the restructuring risk of Icelandic corporations, a designation that included group-affiliated firms.

2. In March 2010, it became clear that the government would not bailout any of its banks or businesses. Instead, creditors of the failed banks had to take over as equity holders of the newly established domestic banks as the government mandated banks to write down any bad debt to eligible firms.

Hoping for Bailout: 2006-2010

It was early 2006. The Icelandic economy was already showing signs of weakness. As the crisis developed, the banks’ systemic importance and expected government bailout were beyond doubt. On March 7th 2006, Merrill Lynch issued an alarming report on the worsening conditions of the Icelandic Bank, titled “Icelandic Banks: Not What You Are Thinking.” In this report, Merrill Lynch (2006) revealed its belief in a banking bailout:

“ However, given the Icelandic government’s currently strong fiscal position and low levels of its own external debt, we would assert that Iceland could ‘afford’ to fix a banking crisis on these (extreme) parameters, though it would almost certainly cost them a notch or two to their current sovereign ratings (Aaa/AA-/Aa-), in our view”

At the same time, JP Morgan (2006) stated its faith that the Icelandic government would bailout its three major banks:

“The logic here is that while the Icelandic part of these firms [the three banks, Glitnir, Kaupthing and Landsbanki] is the most risky it is also the part most likely to be supported by the sovereign. Obviously investors may wish to use their own factor inputs [..] What would happen if the worse case happened? Such as the economy goes into a sharp recession or the stock market crashes or these firms have insufficient funding – would the government bail them out? We believe the government would bail out the core Icelandic businesses, but we remain unsure about all the overseas divisions.”.

On October 6th 2008, the banks were no longer able to refinance their front loaded payment schedule in the next 6 months, which amounted to as much as 20% of Iceland’s GDP. The Icelandic government indeed took over these banks at the height of the crisis, and put the foreign part of them into receivership. A formal banking bailout seemed to be alive in the form of having non-performing loans sitting indefinitely on the balance sheet of these banks, much like what China did with its state-owned conglomerates during the GFC, and what Japan did with its Keiretsu in the Asian Crisis of the nineties. Indeed, even though more than half of the Icelandic firms were technically underwater during this period, we only observe 2 debt write-offs prior to 2010 in our data.

Post 2010: The Case for No Bailout

Yet, things quickly spiraled out of control. By late 2008, the Icelandic economy was in the perfect storm: inflation soared to 18,1%, policy rates were hiked to 18%, unemployment broke 9%, and the currency plummeted by 50%; and seemed to be on an upward trajectory. Hence, capital controls were installed under the IMF program in November 2008. Worse still, once the government took over the three major banks, it quickly realized that the banks were in worse shape than it had previously thought. According to IMF’s calculations, close to 65% of loans in the banking sector were non-performing, while the assets of the three banks totaled more than 10 times the national GDP, IMF (2010). Consequently, the government passed the ownership to the creditors who already were in control of the foreign part of the failed banks. Negotiations on banks’ short term funding and elevated equity funding culminated in a formal agreement between the government and the foreign creditors in March 2010, as foreign creditors took over the newly established domestic arms of Islandsbanki (formerly Glitnir) and Arion banki (formerly Kaupthing) as equity holders. The third bank, Landsbanki, remained in state ownership, as main creditors of Landsbanki were depositors.

Meanwhile, the government ordered a massive debt relief with the enactment of law nr. 107/2009. According to the law, all major financial institutions abided to a coordinated debt relief for individuals and businesses. Households in dire straights would get payment holiday as their case was being processed by the debtor’s ombudsman. In general, households received debt-relief on mortgages exceeding 110% loan-to-value if the owner resided in the property. Businesses were considered eligible for the debt relief program if its management could, in co-operation with its house bank, show that: 1) the firm would be a going concern with restructuring; 2) prospects of bank recovering would be higher than without restructuring; 3) current management/owners would be essential for materializing prospective upside; 4) current management/owners would allow different creditors to consolidate the debt, if needed, or cooperate with other creditors to reach the necessary type of restructuring to keep the firm afloat; 6) current management/owners would be ready for due diligence performed on their business; and that 7) other creditors would unlikely demand bankruptcy of the firm. Again, once the business proved its eligibility for debt relief, bankers were mandated by law to write down their debt. Aside from the government commanded debt relief, borrowers got another windfall from the courts, who declared FX-indexed debt debenture illegal, alleviating the FX-risk borrowers had taken on by entering into these debt contracts. This bill was footed by the banks themselves, or the foreign creditors and other owners of the new domestic banks. As a second external shock to the banking operations, the court rulings in several court cases involving individual borrowers holding the banks responsible for the FX-risk associated with currency linked debt debenture. The courts ruled in favor of the borrower in most cases, leading to recalculation of many FX loans, whose principles were brought down to reflect the devaluation of the ISK, yet at the present value reflecting the yield of the currency in which the cash-flow of the debenture was linked to.

Summary: Textual Evidence for Quasi-Natural Experiment

The textual analysis we provided in the previous sections shows that:

1. There’s a direct shock to banking bailout: In the beginning of the financial crisis, it was widely expected that the government would be willing and able to bailout its major banks. As the crisis developed, the government indeed took over all three of its major banks. But in 2009, once the extent of the non performing loans was uncovered the government was no longer willing to bailout all three banks.

2. There’s an indirect shock to business group bailout: Our textual analysis was not directly applied to systemically important business, because the magnitude of the banking crisis (at 10 times GDP) dwarfs any individual business’ struggle. Nonetheless, we argue that there’s still an indirect, exogenous shock to the supply of lending to business groups. Had the banking bailout been manageable, it would have been conceivable that the next logical step is to bailout systemically important firms.

The bailout could have come in two forms: direct assistance to the group, or indirect assistance through a banking bailout, through which the repayment schedule could have been extended without jeopardizing the banks or the businesses’ continuous operations. If either materialized, the bankers would not have to realize the downside risk on lending to these firms – effectively lowering the ex ante risk on loans. Unfortunately, neither materialized. Instead, bankers were mandated to write-down the non-performing loans of any eligible business. Had they expected any form of government assistantship to these systemically important business groups prior to the crisis, they would have been disappointed. Indeed this is what we observe in the data.

Data

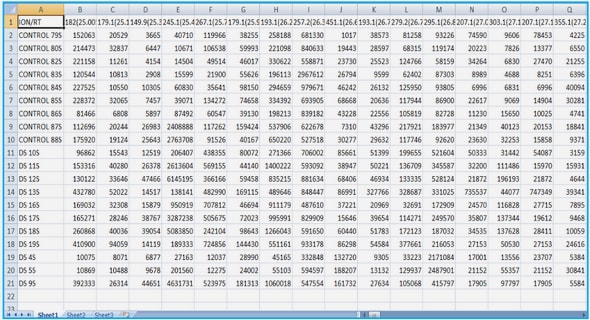

Our dataset is provided by CreditInfo, a credit rating agency in Iceland. The vendor provides annual ownership and financial statement data on all active Icelandic firms in between 2008-2015 (and onwards), from which we constructed a few ownership network based variables. We also extract the firm characteristics control variables as commonly used in this literature.

Note that since this is a crisis data, many financial ratios are outside the usual 0 to 1 interval as we observed in Table 2.1 and Table 2.2. This makes sample selection a very difficult task: if we restrict our attention only to firms that reside in the 0 to 1 intervals, we would greatly reduce the sample size, as more than half of the firms were underwater during the crisis. Moreover, it is conceivable that it is precisely these firms that are generating the effect we’re studying here. On the other hand, if we study the entire sample, the effect seems to be too big to be realistic, potentially being influenced by outliers unduly. We therefore resolve to have leverage ratio, earnings ratio and firm size winsorized, trimmed cut at (10,90) level and consider our results to be a conservative lower bound. The resulting sample statistics is presented in Table 1.3.

Understanding Exogenous Shock Using Data

In Table 1.4, we run a probit regression (1) to understand who is more likely to be underwater in 2008. After controlling for firm-characteristics and industry at 3-digit level, we find that all group affiliated firms are more likely to be distressed, regardless of their hierarchical position within the business group compared to stand-alone firms (our base case/control).

In table 1.4, model 2, we run another probit regression to understand who is more likely to receive a write-off. After controlling for firm characteristics and industry at 3-digit level, the point estimates suggest that all group affiliated firms are more likely to receive a write-down compared to stand-alone firms. But standard error suggest that only the estimate for group affiliated firm held by an individual (ga_heldByIndiv) and group affiliated firms that is a holding company (holdsMulitiple20) are significant at 95% level.

We asked conditional on receiving the write-down, which firms would get the bigger write-offs, but the magnitude is quite small (less than 1%) and not significant, noting that the debt relief program of the government was universal, Landsbanki (2012).

Calculating the average marginal probabilities we see that firms held by another firm (ga_heldbyFirm20) are 4.1% more likely than stand alone firm to be underwater while firms in a business group owned by an individual (ga_heldbyIndiv20), were 5,5% more likely. However, firms in the ultimate ownership of a holding company and holding companies were 11% and 12.4% more likely to be in financial distress than a stand-alone firm, respectively, during the period 2008-2015.

Testable Predictions

How would this write-down affect the lending practice to group-affiliated firms? There are two channels: (1) once the bankers realized the increased risk on lending to group affiliated firms, supply shifts left. This suggests that the price of loans would increase, and the quantity of loans would decrease; (2) once these group affiliated firms realized that they can get away with not paying the full amount of the debt, demand shifts right.

Thus, our prediction for interest rate is unambiguous: it would go up.

Whether the quantity of loan would go up or down depends on whether the supply or demand shift dominates. Unfortunately we do not have loan level data. So in the following analysis, we use (interest expense to total liability ratio as) a proxy for interest rate.

Results

Pooled OLS

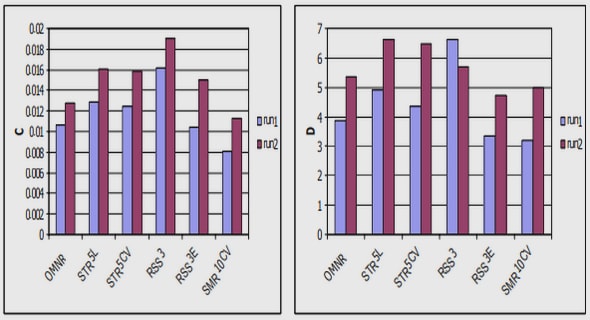

We then turn to testing whether the pricing of credit to group-affiliated firms changed along with the expectations of a government bailout, as the Icelandic government unexpectedly withdrew their plans on assuming the role of an equity holder in the failed banks, and pushed that risk over to the creditors of the banks. Table 2.5 reports on our test of pooled OLS results on interest rate proxy for the period 2008-2009 (4) and 2011-2014 (5) separately.

With the exception of holdsMultiple20, the two pooled OLS results show that interest rates are lower for all group-affiliated firms both prior and after 2010; but it did increase for group affiliated firms after 2010, consistent with our prediction. The coefficient on holdsMultiple20 is not statistically significant in the 2008-2009 pooled OLS regression, but became significantly negative in the 2011-2015 pooled OLS regression. Before the government intervention of non-bailout, group affiliated firms paid between 0.4% to 1% less interest on their loans than stand-alone firms, with firms in the ownership of holding companies receiving the largest statistically significant discount, at the 95% level. The group-affiliation discount survived the government intervention of a non-bailout, it however dropped by 19-46 basis points, on average, depending on the type of group affiliation. Now that we’ve unveiled the changes in pricing of credit risk to group affiliated firms in relations to the exogenous shock of non-bailout event, we look at how leveraged these firms were, compared to stand alone firms. Remembering that the government intervention involved debt relief for all firms, viable and going concern, given certain conditions.1 In table 1.6, we report pooled OLS results on leverage ratio for the period 2008-2009 (5) and 2011-2015 (6), separately. We found that 1) the coefficients on ga_heldByFirm20, ga_heldByIndividual20 and holdMultiple20 all increased; 2) the coefficient on ga_uo_holdFirm20 decreased.

Table of contents :

Introduction

Chapter 1 The Logic of Business Groups: A Moral Hazard Perspective

1.1. Introduction

1.2. Bailout or No Bailout? The Icelandic Surprise

1.2.1 Hoping for Bailout: 2006-2010

1.2.2 Post 2010: The Case for No Bailout

1.2.3 Summary: Textual Evidence for Quasi-Natural Experiment

1.3. Data

1.3.1 Understanding Exogenous Shock Using Data

1.4 Testable Predictions

1.5 Results

1.5.1 Pooled OLS

1.5.3 Fixed effects

1.6 Robustness Checks

1.7 Interpretations, alternative explanations and conclusion

1.8 References

Chapter 2 Nature or Nurture? Revisiting the Gender Risk Aversion Difference in Corporate Finance

2.1 Introduction

2.2. Literature Review

2.3 Identification Strategy and Data

2.3.1. First born child as IV

2.3.2. Gender ratio as IV

2.3.3. Financial data

2.3.4. Instrumental Variables: Challenges

2.3.5 Instrumental Variables: Plan B

2.5 Identification Assumptions

2.6 Summary of Statistics

2.6.1 A Highly Gender Equal Sample

2.6.2 No observable gender difference in raw data

2.7 Pooled OLS, Fixed Effects and Probit Results

2.7.1 What we estimate

2.7.2 Samples

2.7.3 Pooled OLS Results

2.7.4 Probit Results

2.8 Instrumental Variables

2.8.1 Gender ratio is the only instrument that makes sense

2.8.2 IV Regressions

2.8.3 Robustness Checks

2.9 Conclusion

2.10 References

Chapter 3 The Wages of Failure: Executive Compensation at the failed Icelandic Banks

3.1 Introduction

3.2 Data

3.3 Wage distributions in the three banks 2004-2008

3.4 CEO Total Compensation

3.4.1 Short term incentive pay and performance targets

3.4.2 Stock Ownership and leveraged stock purchases of CEOs

3.5 Falsification of Equity through Incentive Pay

3.6 Conclusion

3.7 Bibliography