Get Complete Project Material File(s) Now! »

Fiscal Authority and Monetary Authority

The fiscal authority in our model, or government, collects labor taxes tt , receives real transfer St from the central bank and issues one-period riskless government nominal debt Bt to finance exogenous public expenditures ¯ G and repay its last period debt Bt 1 with interests it 1. Since the focus of our analysis is about monetary policy and therefore central bank, the government does not play a very active role in our model. The government budget constraint at period t is given by ¯ 1(1 + it 1) = (1 l )ttWt NR;t + l ttWt NK;t + Pt St + Bt (16) Pt G + Bt ¯.

We assume that the government targets a real value of debt Bt = B and public expenditures ¯ which will be chosen to match the ratio debt-to-GDP and public spending-to-GDP in Europe. Finally, to close the government budget constraint, we assume that taxes tt simply adjust to match the changes in central bank transfer St .

The important part of our model is the monetary authority, or the central bank. In most models, central bank is assumed to meet its target, either on inflation or output gap, by controlling nominal interest rate through the Taylor rule. In our model, this conventional tool is replaced by the direct control of money supply. The central bank can issue new reserves DMt = Mt Mt 1 and use it for monetary policy purposes, either by giving the money directly to people (helicopter money) or by buying government debt to households (quantitative easing). In either case, the money creation is supposed to follow an AR(1) process in the growth rate with the following rule:

Mt Mt 1 ¯ Mt 1 Mt 2 M

= (1 fm)(p 1) + fm + et (17)

Mt 1 Mt 2.

In this rule, p¯ is the inflation targeted by the central bank. At the steady state where Mt Mt 1 = Mt 1 Mt 2 = m, this rule means that m = p¯ 1, so that the growth rate Mt 1 Mt 2 ¯ (recall that is the gross inflation rate, of money is equal to the btargeted inflation equal for example to 1.02 if the targeted inflation is 2%). In this rule, fm 2 [0; 1] is a persistence coefficient: a shock etM in the growth rate at the period t still has an effect of fm at the period t + 1, fm2 at the period t + 2, and vanishes after some periods since fm < 1. This means that a monetary shock eM will create a total increase of eM in the money supply. The main point of our paper is to see the effect of this shock in our economy: the baseline value for this shock will be calibrated in the following experiments such that the initial new money DMt is equal to 1% of the steady state output. The central bank uses the new created money in two different ways: a fraction x 2 [0; 1] is transferred directly to households through the transfer Tt (we call this scenario ”helicopter money”) and a fraction 1 x is used to increase the central bank government debt holding BtM by purchasing public bonds to households (we call this scenario ”quantitative easing”). In both cases, new money will be held by households, but the effects will be different since helicopter money is equally distributed among all people, whereas quantitative easing goes to Ricardian households who are the only ones to hold government debt. Formally, these two scenarios writes

Pt Tt = xDMt (18)

BM=BM 1 + (1 x)DMt (19).

Moreover, we suppose that the central bank does not make any profit and transfers to the government the interests it receives from its debt holding. The transfer St to the government is then equal to P S = i 1 BM 1 (20)

This transfer creates an indirect effect that is specific to quantitative easing: when the central bank owns the public debt, it lowers the debt service for the govern-ment, because the government pays the interest only on the debt held by house-holds. Then it reduces taxes paid by households, which has a positive effect on the economy. However, this effect is extremely small: if the central bank increases by 1% its public debt holding, and if the interest rate is 1%, then the tax rate will decrease by 0:01 0:01 = 0:0001, which is negligible. Finally, the previous equations lead to the following budget constraint for the central bank: BM + Pt SG + Pt Tt = BM 1 (1 + it 1) + DMt (21).

Note that, at the steady state, the transfer to government is equal to S = ibM with bM = BPM the real value of the steady state central bank debt holding, and the tax ¯ + H G ib rate is equal to t = wN , i.e. the public spending and the service of the debt divided by the aggregate labor income.

Markets clearing conditions and equilibrium

Finally, to close the model, we have the following market clearing conditions for goods, debt, consumption, money and labor:

Yt = Ct + G + q (pt 1)2 (22)

B = (1 l )BH + BM (23)

R;t t

Ct = lCK;t + (1 l )CR;t (24)

Mt = l MK;t + (1 l )MR;t (25)

Nt = l NK;t + (1 l )NR;t (26)

Given laws of motion for the exogenous states feM; Ag, the equilibrium is defined as joint law of motion for households’ choices fNi;t ;Ci;t ; BHi;t gi2fR;Kg, government and central bank choices ft; G; S; T; Mg, aggregate quantities fY; N;Cg, prices and dividends fp; Dg, such that 8t, (i) Each household i 2 fR; Kg maximizes (1) subject to the constraints (2), (6) and

(ii) Firms in total produce Yt = Zt Nt1 a , pay out dividends according to (15), and set nominal prices such that the New Keynesian Phillips Curve (14) holds;

(iii) The government’s and central bank’s budget constraints, (16) and (21), hold;

(iv) The central bank conducts the monetary policy according to (17), (18), (19) and (20);

(v) all markets clear, according to (22) to (26).

Helicopter money and quantitative easing

Calibration

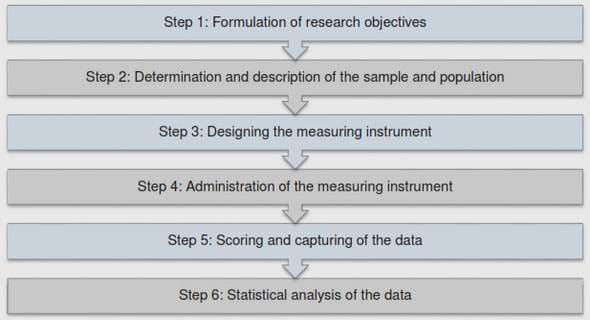

Before we start showing the results from our experiments, we describe the cali-bration for each parameter, and we summarize it in the Table 1. In the sensitivity analysis later in this document, we consider alternative calibrations for the main parameters.

We target a labor supply equal to N = NR = NK = 1=3 at steady state, so that we calibrate the parameters scaling the disutility of labor yR and yK to respec-tively 300 and 701. This gives us the steady state level of output (equal to 0.44); we target a ratio of government expenditures to output of 25 percent, in line with national accounts data, and a ratio of debt to output of 98 percent, which is the average in Europe after the Covid crisis. We assume that the central bank tar-gets zero inflation in the steady state, i.e. p = 1. We calibrate the labor income share 1 a = 0:75 which is similar to values found in the literature and in Gali (2014). Since w = m e e 1 at the steady state, we calibrate e = 8 to have a steady-state markup of 12.5 percent. We set bR = 0:995, which corresponds to an annual interest rate of two percent; bK is set to 0:95 as in Bilbiie, Monacelli and Perotti (2013). The inverse Frisch elasticity of labor supply j is set to 5 as in Gali (2014), which implies a Frisch elasticity equal to 0.2. The weight of the money in the util-ity function, c, is set to 0.0377 to match the ratio between quarterly consumption and the monetary aggregate M3 in Europe. The price adjustment cost parameter is set to q = 47:1, which corresponds to an average price duration of three quarters in the Calvo equivalent of the model. The share of Keynesian agents is set to 0.35 as in Bilbiie, Monacelli and Perotti (2013). Finally, the persistence coefficients for monetary and productivity shocks are set to fM = 0:5 and r = 0:9, as in Cui and Sterk (2019).

Helicopter money

We are now able to simulate our model using the calibration above. All the im-pulse response functions shown below are the response of variables to a money creation shock etM in the money rule calibrated to be equal to 1% of the steady state output, i.e. DMt = 1%Y . Since the persistence coefficient of the shock is equal to fM = 0:5, this means that the total of the new money created is equal to 2% of the steady state output. All results are in % deviation from steady state level (vertical axis) and the unit of time is one quarter (horizontal axis).

As we see in the Figure 1, a money creation DMt initially equal to 1% of steady state output triggers an increase of 0.25% in aggregate consumption, 0.21% in hours worked and 0.19% in output on impact: people have more money, the ag-gregate demand increases, so that output and employment increase to match this new demand. These increases in labor demand and good demand lead to a 0.14% increase in inflation and 0.66% in real wage. Since real wage increases more than inflation, dividends decrease by 2%. Finally, the tax rate decreases by 1.4%, be-cause the general taxable labor income increases whereas government spending are still fixed. All these effects decrease with time and economy goes back to its steady state level. If we compute the sum of responses to this total 2% of GDP money creation, we get that GDP increases by 0.6%, consumption by 0.8% and inflation by 0.4%. These results rely heavily on the persistence of the monetary shock: with fM = 0:9 instead of 0.5, as we will see later in the sensitivity analysis, the total (and instantaneous) effects would be much higher. Still, this first figure gives us important insight into the effect of helicopter money: helicopter money yields sizable effects on aggregate variables, and the ”gain” of this monetary policy, i.e. the increase in consumption, is higher than the ”cost”, i.e. the increase in inflation.

Another key dimension of our model is the heterogeneity between households. The previous graph teaches us nothing about the effect of helicopter money on both types of households, even if we can make some guess: since the real wage increases for both agents, and since dividends decrease only for Ricardian house-holds, we can imagine that helicopter money reduces consumption heterogene-ity, increases Keynesian consumption, and the effect on Ricardian consumption is indeterminate a priori. The following figure 2 presents the impulse response functions for disaggregated variables:

The first row presents the variables CK ; NK ; MPK for Keynesian households. Key-nesian consumption increases by 0.5% and employment by 0.2% on impact. The employment response is even slightly negative at one point, because the agent prefers to reduce its employment since its consumption is still high (i.e. at some point, the wealth effect dominates the substitution effect induced by the increase in real wage). Then helicopter money has a positive effect on Keynesian house-holds: the direct effect of the transfer and the wage increase triggers a substantial increase of the Keynesian consumption. The second row presents the variables CR; NR; MPR for Ricardian households. Ricardian consumption increases by 0.18% and employment by 0.23% on impact. However, consumption response becomes negative at one point. As we mentioned above, this is due to the dividend chan-nel: while both agents enjoy the increase in wage and the transfer from the central bank, the decrease in dividends is supported only by Ricardian households who own the firms. The rigidity in our model creates a long-lasting increase in wages (and then a long-lasting decrease in dividends), whereas the positive effect of the transfer is much shorter due to the low persistence of the monetary shock. Then, on the three effects induced by helicopter money (direct effect of the trans-fer, increase in wage, decrease in dividends), the two first benefit equally to all households, whereas the third triggers a negative consumption response only for Ricardian agents. This is reflected in the last graph of the figure 2, which is the consumption ratio between Ricardian and Keynesian households equal to CR;t . At CK;t the steady state, this ratio in our model is equal to 1.6, which means that Ricar-dian households consume 60% more than Keynesian households. We interpret this parameter as a very stylized measure of inequality: as we see, it decreases up to 0.5% after 4 periods. This means that helicopter money, through the effects mentioned above, reduces inequality and benefit mostly to Keynesian households.

At this point, we have seen that helicopter money, i.e. money creation trans-ferred to all households, has a significant impact on output and consumption, and that inflation is almost half less responsive than aggregate consumption. More-over, the benefits of helicopter money are higher for Keynesian households, be-cause dividends fall for Ricardian agents. We now have to compare this hypothetical monetary policy with the quantitative easing policy that has been used since 2008.

Helicopter versus QE

As we have seen above, the helicopter money is a combination of three effects: the direct effect of the transfer which relaxes the budget constraint, the general equilibrium effect on employment and wage due to the increase in aggregate de-mand, and the dividends channel that concerns only Ricardian households since they own all the firms. The quantitative easing is different: the money created is not transferred to households, but used by the central bank to purchase govern-ment debt from Ricardian households. This purchase replaces an illiquid asset, the governement bond, by a liquid asset, money: this creates an increase in Ricardian demand, an increase in employment and output to match the demand, and then an increase in wage that benefits to all households, especially Keynesian households that did not receive money from the QE in the first place. Hence in QE and as opposed to helicopter money, the direct effect is only for Ricardian households, whereas the general equilibrium effects are for everyone, but may be smaller than previously due to the lower MPC for Ricardian households. The following graphs show the impulse response functions of the aggregate variables after a QE shock, calibrated to be equal to 1% of the steady state GDP as previously. Since the gov-ernement debt is equal to 98% of GDP, this means that the central bank acquires almost 1% of the public debt on impact, and about 2% in total.

As we see in the figure 3, the responses of aggregate variables after a QE shock are slightly below those for helicopter money on impact, with an increase of aggregate consumption by 0.21%, 0.10% in inflation and 0.16% in output (against 0.25, 0.14 and 0.19 with helicopter money). This result is logical: since all the new created money is concentrated on Ricardian households, and since they have a marginal propensity to consume smaller than the average population due to their high discount factor, all the aggregate effects are reduced compared to helicopter money. The figure 4 illustrates the slight difference between these policies.

On impact and during some periods, helicopter money triggers a higher reac-tion than QE. However, after some periods, consumption, output and inflation are higher in the QE scenario: this is due to the fact that since the central bank owns part of the public debt, the debt service decreases for the government (because it does not pay interests on the debt held by the central bank), so taxes decrease slightly. Hence QE and helicopter are comparable in their overall magnitude: he-licopter money creates a slightly higher reaction on impact, and QE lasts a bit longer. However, the true difference between QE and helicopter money appears when we look at disaggregated variables as in the figure 5.

If the figure 4 can make us think that QE and helicopter money are approximately equivalent, figure 5 tells a completely different story. As we see, quantitative easing is biased towards Ricardian households: while helicopter increases Key-nesian consumption more than QE, it is the opposite for Ricardian consumption. Indeed, Ricardian consumption response turns out to be even negative with quan-titative easing: the increase in real wage and the transfer do not compensate the fall of dividends induced by helicopter money, so that the Ricardian consumption decrease. The comparison between the two first rows are striking: QE and heli-copter money are almost symmetrical with respect to both types. Yet we can note that the Keynesian consumption increase following helicopter is twice higher in magnitude than the Ricardian consumption increase following quantitative easing (0.46% against 0.22%). Finally, the difference between both policies is captured by the last graph of the figure 5: the consumption ratio, which is our measure for inequality, decreases strongly with helicopter money but much less with quantita-tive easing.

Overall, we have seen that quantitative easing yields similar results as heli-copter money for aggregate variables: the small difference is that QE effect is slightly weaker on impact, but lasts longer. However, the effects of both policies on disaggregate variables are different: quantitative easing is biased towards Ri-cardian households, whereas helicopter money increases Keynesian consumption and reduces the consumption ratio.

Sensitivity analysis and robustness

Before assessing the effects of the quantitative easing program in Europe since 2008, we briefly discuss the robustness and the sensitivity analysis of the impulse response functions presented above. For the sake of brevity, the IRFs we discuss in this section are presented in the appendix. We mainly focus on three parame-ters: the weight of money in the utility function c, the persistence parameter fM and the price rigidity q , and we also compute for each calibration the cumulative consumption multiplier (1 fM)å¥ ct . t=0 b.

The weight of money in the utility function c governs the ratio between quar-terly consumption and monetary aggregate at the equilibrium. In the baseline calibration, we have used the value c = 0:0377 to match the ratio ”quarterly con-sumption over M3”, equal to 0.12 in Europe. However, Punzo & Rossi (2016) use c = 0:08 in their utility function. A higher value means that households value more money compared to consumption so that, when the central bank transfers money to households, they increase their money holding and less their consump-tion. Then we can expect than, the higher c, the lower the effects of helicopter money. In the figure A1 in appendix, we compute the impulse response functions for three values of c: c = 0:02, c = 0:0377 and c = 0:08. As we expected, all the responses are smaller when c increases, with the cumulative consumption multi-plier respectively equal to 0:64, 0:30 and 0:12. Then on impact and cumulatively, our responses and our results are inversely proportional to c. However, our base-line calibration for c may be already an upper bound, since we have chosen M3 as the empirical counterpart: our c would have been smaller using M2, M1 or even M0, and then our responses would have been higher.

The persistence fM of the monetary shock is important as it directly governs the quantity of new money created. Indeed, if we introduce a shock on money creation equal to 1% of steady state output, a persistence equal to fM = 0:5 im-plies a total amount of new money equal to 2% of steady state output, whereas fM = 0:9 implies a value of 10%. We may expect that, the higher the persistence, the higher the response, both on impact and during the whole period. In the figure A2 in appendix, we compute the impulse response functions for three values of fM: fM = 0:2, fM = 0:5 and fM = 0:9. Not surprisingly, we find that the effect is higher with a higher persistence. However, the cumulative consumption multi-plier, which relates the total effects with the total size of the shock, is respectively equal to 0:31, 0:30 and 0:27, which means that the cumulative gains are almost proportional to the cumulative new money created. The policy implication of this result is that, according to the model, we will reach the same cumulative gains if we give the same amount of money in one transfer, or distribute it over time.

Finally, the non-neutrality of money in our model comes from the fact that there is price adjustment cost, which creates a nominal rigidity, because firms gradually adjust their prices over time instead of fully absorbing the rise in money supply by increasing proportionally prices. The higher the price adjustment cost, the higher the rigidity, so that inflation is less reactive on impact (if is too costly to adjust prices, the inflation will rise much more gradually), but consumption and output are much more reactive on impact, because the money supply increases a lot but not the prices, so the purchasing power increases. In the figure A3 in appendix, we compute the impulse response functions for three values of q : q = 0 (no rigidity, full flexibility), q = 47:1 (baseline, average price duration: 3 quarters) and q = 300 (high rigidity). As we see, with fully flexible prices, all the new money created is absorbed by the rise in inflation, so that the change in output and consumption is small. At the opposite, when the rigidity is high, the response is more important than in the baseline. This translates into higher multiplier with higher rigidity, with a cumulative consumption multiplier equal to respectively 0:02, 0:30 and 1:04. Then the monetary policy is increasingly efficient when the rigidity increases.

Estimation of the efficiency of QE in Europe since 2008

Until now, we have computed our experiments by simulating a money creation shock equal to 1% of steady state output, with a baseline persistence of 0:5. While the theoretical results for helicopter money and quantitative easing are interesting, we must go back to data and calibrate the size of the shock according to the actual assets purchase program conducted by the European Central Bank since 2008. In this section, we use for our analysis ECB data about GDP in the Euro area and about securities held for monetary policy purposes in the Eurosystem1. As we see in figure 6, the first ECB quantitative easing program started in 2009 until 2012 (at 283 billion and 3% Euro GDP), before being renewed and significantly increased in 2015 until today. In 2019, ECB holds 2650 billion Euro assets representing 22% of GDP in Europe; we stop our analysis at 2019 to avoid perturbations due to Covid crisis, but in April 2021 the ECB holds 3936 billion Euro assets, which is a massive increase.

Considering the ECB assets purchase program as a flux rather than a stock (i.e. we consider the change in ECB assets holding over time relative to GDP), we are able to simulate the effect of quantitative easing between 2009 and 2019. We replace in our model the monetary shock eM by the actual sequence of assets purchase in % output, and we set the persistence at fM = 0. We obtained the estimated effect of quantitative easing between 2009 and 2019 in Europe that we plot in the figure 7.

As we see, the assets purchase program of the ECB has a significant effect on in-flation, output and consumption between 2009 and 2019. The size of the program was small between 2009 and 2015: the pick of 2012 contributed to an increase of 0.21% in consumption and 0.12% in inflation. As we see, inflation is almost twice less responsive than inflation. However, after 2015, the QE program became much more important, and contributed to sizable increase of GDP by 1%, consumption by 1.3% and inflation by 0.7% in 2018, the year the ECB bought the most assets. To compare with the existing literature, Hohberger et al. (2019) compute that the QE increased GDP by 0.3% and inflation by 0.5% on average between 2015 and 2019: we find an increase of respectively 0.6% and 0.5% on the same period. However, as we explained previously, QE is biased towards Ricardian agents, so that it increased consumption heterogeneity between 2009 and 2019 by about 1%.

After the estimation of the effects of QE since 2009, we now estimate what could have been the effects of the same amount of money creation, but distributed through helicopter money rather than quantitative easing. Then we estimate the same model and the same sequence of shock, but money is distributed directly to all households by transfers. The results of this experiment and the comparison with QE are reported in figure 8.

We have seen previously that the effect of helicopter money was higher than QE on impact, because QE targets households with lower marginal propensity to con-sume than average. The figure 8 shows us what could have been the magnitude of this difference, if we have used helicopter money instead of QE between 2009 and 2019. Before 2015, this difference is small, but it increases significantly after: in 2018, helicopter money could have increased output by 0.5%, consumption by 0.7% and inflation by 0.2% (which, in this case, is not necessarily a gain) com-pared to QE. Overall, if we sum the responses, we estimate that QE has con-tributed to increase output, consumption and inflation by respectively 3.6%, 4.8% and 2.6% between 2009 and 2019, while helicopter money could have contributed to increase these variables by respectively 5.5%, 7.3% and 3.7% in the same period. Moreover, the important difference between these two un-conventional monetary policies relates to heterogeneity between households. As we have seen before, helicopter money is more equal than QE by construction. While we estimate that QE has contributed to increase the consumption ratio, our very stylized measure of inequality, by about 1%, helicopter money would have reduced this ratio by almost 6%. Then helicopter money would have yield higher gains than QE in terms of consumption and output, and higher costs in term of inflation (if we admit that inflation is bad, which is not necessarily the case since the central bank has trouble reaching its 2% target). Moreover, helicopter money could have reduced inequality, where quantitative easing has increased it.

Welfare analysis

We have computed in section 3 the effects of helicopter money and quantitative easing in our model for a baseline money creation shock equal to 1% of steady state output, with a persistence equal to 0.5. We now turn to the welfare analysis of this shock, i.e. we try to estimate if these policies increase the welfare of households. We have two ways to evaluate the welfare: compute the consumption equivalence, or use a utilitarian criterion.

Consumption equivalent

The idea behind the ”consumption equivalent” is to answer the question: what is the permanent increase in consumption that gives me the same utility as the pol-icy? Or, equivalently, by how much do you agree to decrease your consumption, forever, to get the policy? We need to compute the permanent increase in consumption such that the infinite discounted sum of utility derived from consump-tion is equal to the utility following the shock. In mathematical terms, denoting cshocki;t the consumption path of type i following a baseline shock of money creation equal to 1% of steady state output, and cSSi the steady state level of consumption of type i, this means that we compute the consumption equivalence (denoted CE) such that å¥ bt log (cSS + CE) = å¥ bt log cshock . For both types (Keyne-t=0 i i t=0 i i;t helicopter money), we then sian and Ricardian) and for both policies (QE and compute the consumption equivalence of the monetary policy.

For quantitative easing, we have seen in Figure 5 that it increases Keynesian consumption by 0.2% on impact, and Ricardian consumption by 0.22%. Then we compute the consumption equivalent, and we find that the quantitative easing shock is equivalent to a permanent increase in consumption of 0.01% for Ricar-dian households, and 0.52% for Keynesian households. We may wonder why the consumption equivalent is much smaller for Ricardian than for Keynesian, while the shock is lower for the latter: this is because the Keynesian discount fac-tor is much lower than the Ricardian one (0.95 against 0.995), so that the gain of the policy, available today, is more valued than the consumption increase in the future. Overall, we see that the quantitative easing benefits to both households, but the gain is negligible for Ricardian households. Of course, with a bigger shock or a higher persistence, the consumption equivalent increases.

For helicopter money, we have seen in Figure 5 that it increases Keynesian consumption by 0.5% on impact, and Ricardian consumption by 0.18%, but the latter responds negatively after some period. Then we compute the consump-tion equivalent, and we find that the helicopter money shock is equivalent to a permanent increase in consumption of -0.03% for Ricardian households, and 1.02% for Keynesian households. This means that for Ricardian households, the decrease in consumption after some periods outweighs the gain on impact, so that they do not benefit from helicopter money, and they incur a (negligible) loss of consumption. However, for Keynesian households, the gain with helicopter money is twice higher than with quantitative easing : 1.02% against 0.52%.

Again, we find that helicopter money benefits more to Keynesian households than quantitative easing. At the aggregate level, since the gain or loss for Ricardian households in both cases are neglible (0.01% and -0.03%), and since the gain for Keynesian households are twice higher with helicopter money, we might think that helicopter money is more welfare-enhancing than quantitative easing.

Table of contents :

1 Introduction

1.1 Related literature

1.2 A simple formula

2 The model

2.1 House holds

2.1.1 Ricardian

2.1.2 Keynesian

2.2 Firms

2.3 Fiscal Authority and Monetary Authority

2.4 Markets clearing conditions and equilibrium

3 Helicopter money and quantitative easing

3.1 Calibration

3.2 Helicopter money

3.3 Helicopter versus QE

3.4 Sensitivity analysis and robustness

4 Estimation of the efficiency of QE in Europe since 2008

5 Welfare analysis

6 Productivity shocks and optimal monetary policy

7 Conclusion

8 References