Get Complete Project Material File(s) Now! »

Students are a valid pool of subjects

Another threat to the external validity of TEG and experiments in general, is that university students are well often invited as subjects. However it is the compliance behavior of taxpayers that researchers want to study. As introduced in Jacquemet and L’Haridon (2017), this threat is worrying only if “(i) real-world economic agents are not university students, and (ii) there are reasons to believe that students behaviour is likely to be different from the [taxpayer] population” (p. 380). There is to worry only if these two points are met.

The first point is indeed valid. Students are not representative of taxpayers. Their social and demographics characteristics are well often different from those of the taxpayers’ population (Alm, Bloomquist, and McKee, 2015). Students also have little to no experience of tax returns filing: e.g. in France they most of the time do not declare their own income and are on their parents’ tax return.

The second point could also be valid. To address it, some experiments vary their pools of sub-jects. Gërxhani and Schram (2006) made different pools of participants play a TEG. They were high school students, university students, high school teachers, nonacademic university staff and academic staff. Authors did this experiment in Albania and in the Netherlands. The results show that tax evasion rates were higher for students compared to teachers. Alm, Bloomquist, and McKee (2015) proposed an experiment where participants were university students or uni-versity staff and faculty. Authors also varied different parameters in the TEG: audit, informa-tion, benefits etc. The results show that students complied differently from staff members. However across the different treatments, changes of compliance rates went in the same direc-tions for both pools of subjects. In Choo, Fonseca, and Myles (2015), 520 individuals played a framed TEG in the first experiment, including 200 students with no prior experience of tax, 200 company employees who declared taxes directly through their company (declaration for salaried employees) and 120 self-employed taxpayers who declared themselves their incomes. Experimenters tested different set of fines and audit probabilities. The results show that there were indeed differences in compliance across groups: students were the least compliant par-ticipants compared to company employees and self-employed taxpayers. However students were more responsive to treatment changes compared to other groups, they complied less after an audit. Removing the tax frame of the experiment, i.e. making it a gamble, suppressed the difference across groups of participants. Norms of compliance from outside the lab were sup-posed to be at the origin of the enhanced compliance observed for non-students participants.

To conclude on the differences coming from the pools of subjects, student and non-student participants are different and they can behave differently (with students being less compliant). This difference could come from a norm from outside the lab and disappears outside the tax frame (Jacquemet and L’Haridon, 2017 already show the impact of experience on lab behavior). It could also come from the fact that real taxpayers benefit from a public good, in real life. This dimension is not taken into account when comparing taxpayers to students, and could explain differences of compliance. Another explanation could come from the difference between social and demographic variable: students can be poorer, younger etc. than real taxpayers. However tax evasion experiments are valuable because changes of students’ behavior are the same, com-pared to non-students. Students sample may be like “fruit flies to the geneticist” (Ashton and Kramer, 1980, p. 13), the first step to generalize a lab experiment to other samples, or to a field experiment. Students are thus a valid pool of subjects for TEG.

Temporal limitation

Muehlbacher and Kirchler (2016) already underlined the temporal problem of compliance: in real life, Austrian taxpayers can know after up to 7 years if their tax declaration is being au-dited. It could lead to a discount of the future fine, or a major stress while waiting for a possible audit. Only three papers studied the impact of temporal distance between the tax declaration and the audit. Muehlbacher, Mittone, Kastlunger, and Kirchler (2012) made participants play a one-shot TEG in which audit results were announced immediately or after three weeks. The results show that immediate feedback provoked higher evasion. Kogler, Mittone, and Kirchler (2016) confirmed this result in a TEG with immediate/non-immediate feedback and repeated periods. However Cadsby, Maynes, and Trivedi (2006) let participants in a TEG think about their tax declarations for one week before filing and it led to the reverse, i.e. tax compliance rates were lower.

Time seems to have different impacts: when participants know that they will have to await a possible audit, they comply more. However when they have more time to declare, they tend to evade more. Even though more evidence should be needed on this point, temporal aspect seems indeed to be a limit on the external validity of TEG.

The decision task in a TEG is a valid measure of tax behavior

Another important criticism towards tax evasion games (as there are against experimental eco-nomics in general) is that one can wonder if the experiments are really revealing of behaviors in the field. In an experiment, choice set is reduced. To illustrate this, in Lazear, Malmendier, and Weber (2012), participants could opt out from a dictator game and it led to significant different sharing rates.

This question is addressed in an analysis done by Bloomquist (2009) and republished in Alm, Bloomquist, and McKee (2015). The aim of the study was to compare reporting behavior from a group of US taxpayers and participants from different tax evasion experiments. Again, tax-payers were Schedule C filers subjected to IRS random audits. The results show similarities in behaviors. In the field, the mean compliance rate was about 31.30% for an audit probability of 1.72%, compared to 28.80% (or 40.40%) compliance when the audit was 0% (or 5%) in the lab. The results show that the distributions of compliance were also similar: both adopted a bi-modal distribution, with the first mode being 0% of compliance and the second one being 100% compliance. Authors also noted that they observed approximately equal shares of fully compliant individuals in both settings. These similarities were being observed when scrutiny, anonymity, context, size of stakes, pool of participants, individual characteristics, time were significantly different.

To conclude on the criticisms of TEG, when compared to the appropriate data, compliance rates obtained in the lab are globally equivalent to those observed in the field, whatever the framing, size of stake and pool of subjects. Therefore Levitt and List (2007) criticisms are not fully righteous, when applied to the external validity of TEG.

The impact of traditional deterrent variables on lab tax compli-ance

It has been shown previously the elements to take into account to produce a valid tax evasion game, and what do these elements produce in terms of compliance. We have also seen pre-viously that the Allingham and Sandmo model predicted that: audit probability, size of fine should increase tax compliance and tax rate should have an ambiguous impact on tax compli-ance. Yitzhaki’s addition predicted that tax rate should have a negative impact on tax evasion. This Section puts theory to the test of experimental practice, it describes below the impact of the traditional deterrent variables–tax rate, audit probability, size of fine–in incentivized TEG

Tax rate

As in the Allingham and Sandmo (1972) model, only TEG using flat tax rate are mentioned here. Existing evidence is inconclusive. The effect of tax rate on lab tax compliance is rather ambiguous. The amount of papers collected here is separated in two paragraphs: first, the papers showing a negative effect of tax rate on compliance. Second, the papers having reversed, mixed or no effects.

Friedland, Maital, and Rutenberg (1978) considered two tax rates: 25% and 50%. When the tax rate was 25%, the proportion of income declared was 87%. When the tax rate was about 50%, the proportion of income declared was 66%. In Baldry (1987), an increase in the marginal tax rate increased also participants’ evasion. In Collins and Plumlee (1991), tax rate was set to 30% or 60%. The results show that when tax rate was high, evasion was higher. In the experiment by Alm, Jackson, and McKee (1992b), the tax rates were 10%, 30% and 50%, leading to average compliance rate equal to 37.60%, 33.20% and 20%. Park and Hyun (2003) varied tax rates in their TEG from 10% to 40%. The results show that increasing tax rate had a significant negative impact on tax compliance. Alm, Deskins, and McKee (2009) also varied tax rate from 35 to 50% in their TEG and showed that it decreased compliance by 11.60 points. The most comprehen-sive study on tax rate is probably from Bernasconi, Corazzini, and Seri (2014) where authors compared two tax rates (27% vs 38%) across different treatments and showed that higher tax rate indeed reduced compliance. In Duch and Solaz (2015), there were different tax rates: 10%, 20% and 30%. In the baseline, the results show that high taxes really deterred compliance. Pe-liova (2015) ran a TEG where tax rates varied from 10% to 40% with increments of 10%. With 20% audit rate, compliance decreased linearly from 62.83% till 45.83% at 30%, where it did not decrease anymore after. With a 5% audit rate, there was a U-shaped relationship between tax rates and evasion: compliance was decreasing from 45.86% at 10% tax rate to 22%, for a 20% and 30% tax rate, then increasing to 29% for a 40% tax rate. In an hypothetical TEG set by Murakami and Taguchi (2015), a tax rate of 30% corresponded to a compliance rate of 80.30%. A 10% increase in the tax rate marginally but significantly increased the compliance rate at 81.46%.

Second, the papers showing mixed or no effects of tax rate on compliance are mentioned here. In Becker, Büchner, and Sleeking (1987), three tax rates were used on earned income: 33.33%, 50% and 66.66%. The results show that participants considering their tax burden as high, were less prone to decide to evade. The amount of income evaded was not correlated with the perceived tax burden. Beck, Davis, and Jung (1991) set a TEG with different tax rates: 25% and 50%. Increasing tax rate in this experiment did not lead to increased compliance. In Alm, Sanchez, and De Juan (1995), tax rates were varied across treatments in the following way: 10%, 30% and 50%. The results show that increasing tax rate increased compliance. Compliance rates were respectively of 14%, 24% and 31%. In the pre-vote rounds of Alm, McClelland, and Schulze (1999), the results show that the effects of tax rate on compliance were negligible, going from 28% compliance at 20% tax rate to 29% compliance at 50% tax rate. In Boylan and Sprinkle (2001), tax rate was either 20% or 40%. When incomes were endowed, doubling the tax rate decreased declaration from 61.50% to 55.30%. When incomes were earned, doubling the tax rate increased declaration from 48% to 68.70%. The results show that there were no effects of sole tax rate, but an interaction effects between nature of income and tax rates. In Fortin, Lacroix, and Villeval (2007), authors varied the tax rate from 5% to 70%. Their results show a U-shaped relationships with compliance: higher tax rates decreased compliance up to a 39% tax, but raised compliance afterward.

To sum up, the impact of the tax rate on tax evasion is not clear. Blackwell (2007) showed in a meta-analysis on 20 experimental articles that increasing the tax rate had a positive–but non-significant–impact on compliance. Andreoni, Erard, and Feinstein (1998) concluded on this topic that “the effect of tax rates on evasion remains unclear » and « given the importance of this topic, it surely deserves further investigation” (p. 839). In this literature review focusing on flat tax rate only, the tax rate seems to deter compliance when it increases. However a quite high number of articles found no effects, reversed or mixed effects. It rather validates the result from Allingham and Sandmo (1972) on the effect of tax rate. There could exist a U-shaped relationship between taxation and compliance. Below 30%, an increase in the tax rate could decrease compliance. A tax rate between 30% to 40% could be a kind of psychological threshold after which the experiment would be no longer seen as a taxation environment. To preserve the perception of a taxation experiment, the flat tax rate should not exceed 40%.

Audit probability

As in the Allingham and Sandmo (1972) model, only experiments using random audits are mentioned here (endogenous audits are not mentioned). Audit has a strong positive impact on lab tax compliance. As in the previous Section, papers showing first a strong positive effect of audit are reviewed below.

Table of contents :

Introduction

0.1 The traditional economic analysis of tax evasion

0.1.1 Economic analysis of crime

0.1.2 Economic analysis of tax evasion

0.1.3 An addition of Yitzhaki

0.2 Methodological approach of conceiving a TEG

0.2.1 Scrutiny of behavior and anonymity of participants

0.2.2 Context of the experiment

0.2.2.1 Neutral vs loaded frame

0.2.2.2 On the way to ask for compliance

0.2.2.3 Origin of income: earned vs windfall income

0.2.2.4 Nature of income: self-employed vs salaried job

0.2.2.5 Redistribution to participants

0.2.2.6 Public good fund

0.2.3 Size of stake

0.2.4 Students are a valid pool of subjects

0.2.5 Temporal limitation

0.2.6 The decision task in a TEG is a valid measure of tax behavior

0.3 The impact of traditional deterrent variables on lab tax compliance

0.3.1 Tax rate

0.3.2 Audit probability

0.3.3 Fine size

0.3.4 From traditional deterrent variables to non-monetary incentives to comply

0.4 Alternative sources of tax compliance

0.4.1 Personality traits

0.4.1.1 Definitions and examples

0.4.1.2 When does personality vary?

0.4.1.3 Does (stable) personality traits really exist?

0.4.2 Context

0.4.2.1 Framing

0.4.2.2 Priming

0.4.2.3 Commitment

0.5 How are context and personality traits integrated into the analysis of tax evasion?

1 Does tax morale really exist? A psychometric investigation

1.1 Introduction

1.2 Foundations of tax morale from moral psychology

1.2.1 Morality and moral emotions

1.2.2 Morality and moral judgment

1.3 Experiment 1

1.3.1 Design of the experiment

1.3.1.1 Psychometric measures of moral emotions

1.3.1.2 Experimental procedure

1.3.2 Results

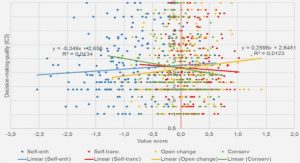

1.3.2.1 Compliance behavior and morality

1.3.2.2 Multivariate analysis

1.3.2.3 Using Principal Component Analysis to combine sub-scales

1.4 Experiment 2

1.4.1 Design of the experiment

1.4.1.1 Psychometric measures of moral judgments

1.4.1.2 Experimental procedure

1.4.2 Results

1.4.2.1 Compliance behavior and morality

1.4.2.2 Multivariate analysis

1.4.2.3 Using Principal Component Analysis to combine sub-scales

1.5 Conclusion

2 Tax evasion under Oath

2.1 Introduction

2.2 Fighting dishonesty with commitment

2.3 Experiment 1

2.3.1 Design of the experiment

2.3.2 Experimental treatment

2.3.3 Experimental procedure

2.4 Results

2.4.1 Descriptive statistics

2.4.2 Income declaration: the impact of individual variables

2.4.3 Income declaration: the oath impact

2.5 Experiment 2

2.5.1 Design of the experiment

2.5.2 Experimental procedure

2.5.3 Descriptive statistics

2.5.4 Income declaration: the oath impact

2.5.5 Compliance under oath: light on the polarization effect

2.6 Conclusion

3 Disentangling commitment from social effect in a voting experiment on tax funds

3.1 Introduction

3.2 Why should voting increase compliance?

3.3 Design of the experiment

3.3.1 Experimental protocol

3.3.2 Avoiding selection effect

3.3.3 Experimental treatments

3.3.4 Experimental procedure

3.4 Comparison of treatments and participants

3.4.1 Participants are globally comparable between treatment

3.4.2 Participants make the same decisions in each treatment

3.5 Results

3.5.1 Descriptive statistics

3.5.2 Direct democracy effect disappears when taking into account the selection

3.5.3 A commitment effect is found but no social effect

3.5.3.1 In the full sample

3.5.3.2 In the truncated sample: keeping people who vary their declarations

3.5.4 Are other variables influencing compliance?

3.5.4.1 Questionnaires’ answers are rather different

3.5.4.2 Perceived legitimacy, fairness and importance of the selection: their impact on compliance

3.6 Conclusion

Conclusion