Get Complete Project Material File(s) Now! »

Model IIa: Asymptotic behavior

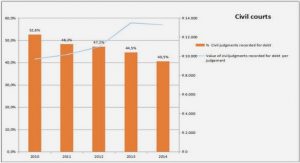

Model IIa belongs to a special class of Markov processes, called quasi birth and death processes (QBD). Their asymptotic behavior can be studied by the matrix geometric method. Denitions of QBD processes and explanations about the matrix geometric method can be found in appendix. In Figure I.5, we show the theoretical joint distribution of (q1,q2) for the stock France Telecom and compare it with the joint distribution estimated from empirical data. Here also, we see that the theoretical results provide a very satisfying approximation.

Model IIb: Modeling bid-ask dependences

We now study the interactions between the bid queues and the ask queues. Let Q0, Q¡, ¯Q, QÅ be four marks which represent in the following ranges of values for the queue sizes. Let m and l be two integers. We dene the function Sm,l (x):

Sm,l (x) Æ Q0 if x Æ 0.

Sm,l (x) Æ Q¡ if 0 Ç x ·m.

Sm,l (x) Æ ¯Q if m Ç x · l.

Sm,l (x) Æ QÅ if x È l .

This function associates to a queue size x four possible ranges: empty: x Æ 0, small: x 2 (0,m], usual: x 2 (m, l ] and large: x 2 (l ,Å1). We set m as the 33% lower quantile and l as the 33% upper quantile of q§1 (conditional on positive values). In this model, market participants at Q§1 adjust their behavior not only according to the target queue size, but also to the size of the opposite queue. The rates ¸L §1 and ¸C §1 are therefore modeled as functions of q§1 and Sm,l (q¨1). As in Model IIa, we suppose that market orders consume volume at the best limits and are only sent to Q§1 and Q§2. When q§1 È 0, the market order intensity ¸M buy/sel l is assumed to be a function of q§1 and Sm,l (q¨1). Regime switching at Q§2 is kept in this model: ¸L §2, ¸C §2 are assumed to be functions of 1q§1È0 and q§2, and when q§1 Æ 0, the market order intensity ¸M buy/sel l is modeled as a function of q§2.

Model IIb: Empirical study

We focus here on the estimation of the intensity functions at Q§1. We consider the departure ow intensities ¸C §1(q§1,Sm,l (q¨1)) and ¸M buy/sel l (q§1,Sm,l (q¨1)), and the arrival ow intensities ¸L §1(q§1,Sm,l (q¨1)). Using again the symmetry property of the LOB, we take ¸L1 (x, y) Æ ¸L ¡1(x, y), ¸C1 (x, y) Æ ¸C ¡1(x, y) and ¸Ms el l (x, y) Æ ¸M buy (x, y). We record the waiting times ¢t (!) between events that happen at Q1 or Q¡1, the types of event T (!) and the two queue sizes (q1(!),q¡1(!)) before the event. Then we estimate these intensity functions using the maximum likelihood method. The results are shown in Figure I.6 (m Æ 4 AES1, l Æ 9 AES1)8. Some remarks are in order:

• Limit order insertion: The limit order insertion rate is a decreasing function of the opposite queue size. In particular, we see that when the opposite queue is empty (pink curve), it is signicantly larger. Indeed, in that case, the “ecient » price is likely to be closer to the opposite side. Therefore limit orders at the non empty rst limit are likely to be protable.

• Limit order cancellation: The cancellation rates for dierent ranges of Q¡1 are similar in their forms but have dierent asymptotic values. This rate is not surprisingly a decreasing function of the liquidity level on the opposite side. Indeed, when this level becomes low, many market participants cancel their limit orders and send market orders since the market is likely to move in an unfavorable direction.

• Market orders: We see that when the liquidity available on the opposite side is abundant, more market orders are sent. Indeed, in that case, transactions at the target queue are relatively cheap as its price level is temporarily closer to the ecient price. In the special situation q¡1 Æ 0, the price level at Q1 can seem relatively attractive since it is much closer to the reference price than the opposite best price, which is in that case 2 ticks away from it. This explains why the market order intensity is larger when the opposite queue is empty than when its size is small.

Model IIb: Asymptotic behavior

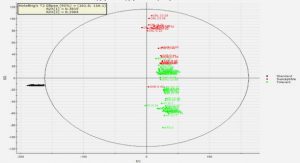

Monte-Carlo simulations are used to obtain the theoretical invariant distribution of the LOB in Model IIb. The theoretical and empirical joint distributions of Q¡1 and Q1 are shown in Figure I.7. The dierence between the two graphs comes from the relatively high probabilities of states of the form (x, y) with x and y both small in empirical data, which are somehow replaced by states of the form (x,0) or (0, y) in the model. Indeed, in practice, a situation where one of the rst queue is empty is not likely to remain long since it often leads to a reference price change.

This eect is not taken into account in Model IIb where the reference price is constant, but will be investigated in Model III in Section 3.1. We anticipate here by giving in Figure I.8 the joint distribution obtained when suitable moves of the reference price are added within the framework of Model IIb (following the approach of Model III in Section 3.1). We now nd that the simulated density becomes very close to the empirical one.

Table of contents :

Contents

Introduction

Motivations

Outline

1 Part I: Limit Order Book Modeling

1.1 The Queue-reactive Model

1.2 A General Framework for Markovian Order Book Modeling

2 Part II: Tick Value Eects

2.1 The Eects of Tick Value Changes on Market Microstructure: Analysis of the 2014 Japanese Experiment

2.2 An Agent-based Model on Order Book Dynamics

Part I Limit Order Book Modelling

I The queue-reactive model

1 Introduction

2 Dynamics of the LOB in a period of constant reference price

2.1 General Framework

2.2 Data description and estimation of the reference price

2.3 Model I: Collection of independent queues

2.4 Model II: Dependent case

2.5 Example of application: Probability of execution

3 The queue-reactive model: a time consistent model with stochastic LOB and dynamic reference price

3.1 Model III: The queue-reactive model

3.2 Example of application: Order placement analysis

4 Conclusion and perspectives

5 Appendix

5.1 Proof of Theorem 1

5.2 Computation of condence intervals

5.3 Quasi birth and death process

5.4 Order Placement Tactic Analysis

5.5 Alcatel-Lucent

5.6 AES

II A General Framework for Markovian Order Book Models

1 Introduction

2 A general Markovian framework

2.1 Representation of the order book

2.2 Dynamics of the order book

2.3 Comparison with existing models

3 Ergodicity

3.1 When pr e f stays constant

3.2 General case

4 Scaling limits

5 Some specic models

5.1 Best bid/best ask Poisson model (Cont and De Larrard (2013))

5.2 Poisson model with K È 1

5.3 Zero-intelligence model

5.4 Queue-reactive model (Huang, Lehalle, and Rosenbaum (2013))

6 Conclusion

7 Appendix

7.1 Proof of Theorem 1

7.2 Proof of Theorem 2

7.3 Proof of Theorem 3

7.4 Proof of Theorem 5

Part II Tick Size Eects

III The Eect of Tick Value Changes on Market Microstructure: Analysis of the Japanese Experiements 2014

1 Introduction

2 Cost of trading and high frequency price dynamics

2.1 The model with uncertainty zones: When the tick prevents price discovery

2.2 Perceived tick size and cost of market orders

2.3 Implicit bid-ask spread and cost of limit orders

2.4 Prediction of the cost of market and limit orders

2.5 What is a suitable tick value?

3 Analysis of the Tokyo Stock Exchange pilot program on tick values

3.1 Data description

3.2 Classication of the stocks in Phase 0

3.3 Phase 0 – Phase 1

3.4 Phase 1 – Phase 2

4 Conclusion

IV Intelligence and Randomness of Market Participants

1 Introduction

2 Basic Model

2.1 Price Dynamics

2.2 Informed Trader, Noise Trader and Market Maker

2.3 Some Assumptions

2.4 Links between the Trade Size Q, Price Jump B and the LOB Cumulative Shape L(x)

2.5 The Bid-Ask Spread and the Equilibrium LOB Shape

2.6 Variance per Trade

3 Tick Size

3.1 Constrained Bid-Ask Spread

3.2 Daily Volume

3.3 Priority Value

4 Examples

4.1 Power-law Distributed Information

5 Generalization

5.1 How Information is Digested

6 Conclusion and perspectives

Bibliography