Get Complete Project Material File(s) Now! »

The drivers of inequality trend

We have established above that the increase of inequalities in Germany are composed of two parts: the increase of the wages disparities and the increase in capital income within the top decile. We are interested in this part, in reviewing the drivers of these inequalities in Germany during the concerned period (1995-2016).

In the literature exploring the factors driving the evolution of inequalities in Germany in the period 1990-2016, many determinants are identified. The most prominent one is the changes in tax system, especially between 2001 and 2006 lightening taxes on the rich. (see Bach et al. (2013) for a detailed presentation of the tax reforms). As an example, the maximum income tax rate decreased gradually from 51% in 2000 to 42% in 2005. These changes decreased the charges on the rich, and increased the tax on the poor, which lead then to increase of the gap between these two categories (see in that respect Biewen and Juhasz, 2012; Bach et al., 2013 and Schmid and Stein, 2013).

Another important driver is the structural changes inside the German labor market, characterized by higher wages inequalities due to the increasing number of atypical low-paid jobs, the de-unionization,and the polarization of wages by some occupations in the detriment of others (as showed by Schmid and Stein, 2013 and Biewen and Juhasz, 2012).

The third factor driving this rise in inequality is the demographic changes happened between 1990 and 2015. Changes that are characterized by a different composition of the household types (smaller households, more single motherhood and single household),and an increase in the employment rate of women relative to men. Jessen (2015) and Zagel and Breen (2019) defend the hypothesis that most of the increase of inequality is due to the changes in the population, while Biewen and Juhasz (2012) and others found that it only have played a minor role.

About the effect of transfer system changes, especially the well-known Hartz reforms between 2003 and 2005, its impact on increasing the gap between the top and bottom incomes groups seems to be largely contested as showed by Biewen and Juhasz (2012), Jessen (2015) and Zagel and Breen (2019) . Even it seems that there was no direct effect of these reforms, this does not rule out the possible spillover effects that could create in the market, specially regarding the reactions of the demand side of the market through more part-time jobs and pulling the wages of the low-skilled workers down.

Regarding the impact of the financial crisis in 2009, Grabka (2015) and Biewen et al. (2017) did not find any significant effect on the income distribution in Germany. Be- sides, Grabka (2015) noted that this financial crisis has helped to stifle the evolution of inequalities by inflicting a severe blow to capital income, which mainly concerns the top decile. As these studies show, other factors have also contributed to the stabilization of the inequality trend shown in Figure 2.3, such as the stagnation of the share of part-time jobs, and the application of a minimum wage by many companies since 2009.

Literature on inequality and support for redistribution

The workhorse economic model in economics regarding the relationship between level of inequality and level of demand for redistribution is the model of Meltzer and Richard (1981), where the level of demand for redistribution depends positively on the level of in-equality.3 Since then, many studies have been conducted, with different empirical strate-gies, to explore this relationship.

The most recurrent and traditional approach is to carry out a cross-country study, by running inter-country (or inter-regional) comparisons on levels of inequality and levels of demand for redistribution (see for example Lübker, 2007; Finseraas, 2009; Engelhardt and Wagener, 2014; Niehues, 2014; Steele, 2015; Rueda and Stegmueller, 2016; Gimpelson and Treisman, 2018 and Choi, 2019 ). The predominant result is that there is a weak relationship between these two indicators: it is not in the most unequal countries that we find the highest levels of demand for redistribution. The main limitation of this ap-proach is the near-impossibility of controlling for the large set of factors that make each country unique, and which are strongly related to the formation of economic preferences. Among these factors we cite political and cultural institutions, the country’s history, the ideological foundations, and so on (see Acemoglu and Robinson, 2013 and Piketty, 2019). Therefore, the empirical validity of these studies remains rather limited.

Like Meltzer and Richard (1981), Fehr and Schmidt (1999)’s theoretical model also implies a positive relationship between the level of inequality and the level of support for redistribution. Alesina and Angeletos (2005)’s model states the opposite: an increase of income inequalities leads to a decrease of the demand for redistribution.

Another approach that has recently been adopted frequently is the experimental approach. In this group of studies, the individual is exposed to information related to inequalities such as income distribution or social mobility in order to observe his/her reaction re-garding his support for redistribution (see for example Kuziemko et al., 2015; Page and Goldstein, 2016; and Alesina et al., 2018b). These studies have also shown a rather flimsy impact of perceptions of inequality on the demand for redistribution, but they have also led to a better understanding of this relationship: acting in the face of inequalities de-pends on several other factors such as the individual political affiliation (Alesina et al., 2018b), the level of trust in government (Kuziemko et al., 2015), beliefs about the living conditions of the poorest (Page and Goldstein, 2016), etc. Although this approach has various advantages, its external validity does not remain without limits.

Concerning the longitudinal approach exploring the simultaneous evolution of inequalities and support for government redistribution overtime, we found very few papers adopting this strategy (see for example Kenworthy and McCall, 2008 and Ashok et al., 2015).4 The two papers show no significant correlation between changes of inequalities and demand for redistribution. This methodology – like the previous two – also suffers from some drawbacks, especially with regard to the validity of attributing the effect of time to a particular event and not to another. Subsequently, appropriate robustness tests are needed to circumvent these limitations. However, the advantage of such an approach over an inter-country approach is that institutional factors are naturally controlled, and that it is manageable to control for a wide range of economic, ideological and other factors since all individuals live in the same country. In the present paper, we adopt the longitudinal approach, exploring trends in inequality levels and attitudes towards redistributive policies for the period 1995-2017 in Germany.

Empirical strategy

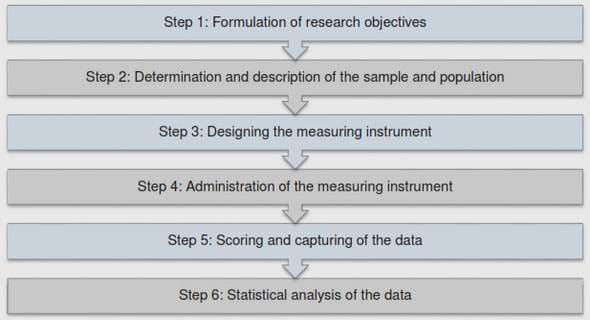

Our empirical analysis proceeds in two principal steps. First, we examine the evolution of demand for redistribution over time, while extensively controlling for a wide range of fac-tors. Second, we test if the evolution of preferences over time is heterogeneous depending on 1) the individual region of residence before 1989 unification (west or east Germany) and 2) the individual financial situation. For ease of interpretation, the dependent vari-ables are all binary variables (1 if the individual is favorable to government intervention and 0 otherwise).

Concerning the first part, we specify an empirical model for each of the two databases, ESS and SOEP. For the ESS data, the baseline specification is a linear probability model (LPM) using robust standard errors to remedy against the heteroscedastic error terms of the following form: GovrIT = 0 + 1XIT + 2Y + ✏it (2.1).

where GovrIT corresponds to the demand for government redistribution of individual i in year t. XIT is the vector of control variables including age, gender, level of education, the financial situation, the political position and the region of residence. Y refers to years from 2002 to 2018.

For SOEP data, we specify the following linear probability model accounting for ran-dom effects (RE-LPM) using robust standard errors, and using the clustering at the family level (according to the family id) to remedy against the serially correlated error terms:9 GovfIT = 0 + 1CIT + 2.Y 17 + 3.NIT + aI + ✏IT (2.2).

Where GovfIT corresponds to the demand for government intervention in financial security areas (Family|Unemployment|Health|Old|Care services) for individual i year t. CIT is the vector of control variables including age, gender, level of education, level of income, supported political party and type of employment. Y 17 is a dummy variable equals to 1 if individual lives in 2017, and 0 if he/she lives in 2002. NIT denotes a set of under-exploited factors regarding these effects of preferences for redistribution including the level of wealth (measured by the ownership of house and the ownership of financial assets), the level of satisfaction with the social security system, level of satisfaction with social security system, the assessment of own level of financial security and the prospect of own situation regarding unemployment and health.

The second part investigates first if the evolution of preferences for redistribution has followed the same pattern regarding the individual’s region of living before 1989 (east or west Germany) relying on SOEP. We specify the following empirical model (RE-LPM): GovfIT = 0 + 1CIT0 + 2.Y 17 + 3.EastGer89I + 4.Y 17 ∗ EastGer89I + aI + ✏IT (2.3).

Alesina’s Prediction on the convergence of preferences between East and West Germany

Review of Alesina and Fuchs-Schündeln (2007) results. Alesina and Fuchs-Schündeln (2007) found that in 1997 and 2002, East Germans are more likely to sup-port state intervention in financial security areas than West Germans. They explain this difference by the fact that East Germany was under communist rule for 30 years, which impacted people’s preferences. However, they found that over time (between 1997 and 2002) this difference become smaller since the interaction term of lived in 1989 in East German and the time variable is significantly negative. Taking into account that the evolution of support for role state in East German is negative, they describe this trend as a convergence for the East German’s preferences towards those of West Germans.

They suppose that this convergence will continue until complete uniformity since the two parts of Germany are under the same political and economic institutions. According to their calculations, a full uniformity of views will occur in 11 years for the attitudes towards the state implication regarding the care policies and 35 years regarding health policies and between these two periods for the three others. Method. We test this empirical prediction 15 years after by computing the same inter-action term (Year*Living in East Germany before 1989) using our panel sub-sample for the two years 2002 and 2017 applied the same configurations presented in equation 2.3. We run also robustness checks using exactly the same specifications and the same control variables as Alesina and Fuchs-Schündeln (2007).

Our results. At first sight, as we can see in Table 2.4, the interaction terms regarding the evolution of preferences over the region of residence in 1989 display negative signs. But if we look at the significance of the coefficients, we find that three of the five interac-tion terms are no statistically significant, only the interaction term regarding the financial security of unemployment is strongly significant. This means that the difference between East and West Germany regarding the support for governmental redistribution did not increase for three of the five attitudes between 2002 and 2017.13 Using the same model specifications used in Alesina and Fuchs-Schündeln (2007), we have qualitatively the same results (see Tables 2.7 and 2.8).

Convergence of preferences of most affluent towards those of the less affluent

In this part, we study the heterogeneity of evolution of preferences for government inter-vention in redistribution depending on the individual economic situation. In ESS data, two variables measure the individual’s financial situation: the first one describes the fi-nancial situation perceived by the individual, and the second informs us about the income decile the individual belongs to. The last variable it is only available from 2008 onwards. We start with the perceived financial situation (Table 2.5), running three separate re-gressions according to the individual’s living conditions (if the person is living with great financial difficulties), or correctly, or is comfortable with his or her current income). The controls variables are the same as the ones used in column 2 of Table 2.2 except of the time coefficient, which is reduced to a binary variable (equals to 0 if the individual is living in 2002-2004 and 1 if he is living in 2012-2018). In Table 2.6, we proceed in the same way but this time according to income deciles (whether the individual belongs to the bottom 50%, the top 20% or between these two groups) and focusing on the evolution occurred between 2008 and 2012-2018 period. The results reported in Tables 2.5 and 2.6 show an heterogeneous evolution of preferences: the increasing support for redistribution is stronger among the affluent (top incomes) compared to the others.

Context: The Egyptian Revolution in 2011

Events and claims. January 25, 2011, can be considered the effective start date of the Egyptian revolution. During the six months before, several events had triggered the popular uprising. On June 6, 2010, the death of Khaled Saïd in police custody received broad press coverage, sparking a rising clamor of indignation in society. Then, the Egyptian parliamentary elections that took place at the end of 2010 were described by human rights groups as the “most fraudulent poll ever” in Egypt’s history. Indeed, 91% of seats were won by Mubarak’s National Democratic Party (NDP). On January 1, one of the most prestigious Coptic churches was the target of a violent bombing (the so-called Alexandria Bombing). On January 6, another story of death by torture in the buildings of the State Security Investigations Services (the highest national internal security authority in Egypt) renewed the anger that had followed Khaled Saïd’s tragic death.

The success of the Tunisian revolution in January 14 was one of the trigger components of the Egyptian revolution, which gave Egyptians a hope for change. Four days after, four individuals self-immolated, imitating what happened in Tunisia at the start of the Tunisian revolution. This chain of events led to a very sharp decrease in the life satisfaction indicator among Egyptians during this period Devarajan and Ianchovichina (2018), which was the breeding ground of the revolution.

On January 25, 2011, opposition groups – among them the “April 6 youth movement” – called for a “Day of Anger” protest. The Facebook page entitled “We are all Khaled Saïd” was a flagship of these protest groups. Demonstrations were held in different cities, drawing Egyptians from all social spheres (Bishara, 2009; Costello et al., 2015). The major claims were to restore human dignity and to reverse restrictions on civil liberties (Dabashi, 2012; Telhami, 2013). The quick mushrooming of this movement in Egypt, compared to other Arab countries, can be explained by the violent way the Egyptian government responded to these demonstrations (Costello et al., 2015), illustrated by a high number of imprisoned persons and deaths during the first days. After 16 days of demonstrations, Hosni Mubarak resigned as president.

This revolution coincided with the revolutionary wave that began in Tunisia in De-cember 2010 and stretched to many other Arab countries, a wave called the “Arab Spring”. In many other countries, such as Morocco and Jordan, similar demonstrations have been held with very close demands and motivations, but without a real change in the political landscape. The success of the Egyptian revolution was the beginning of a series of changes regarding the social and political life of Egyptian citizens.

An improving economic situation in the early 2000s. Contrary to what might be expected, most economic indicators were improving from 2000 to 2011 (Giesing and Musić, 2019). From 2004 to the eve of the Egyptian revolution, the growth rate was always positive and quite high (between 4.09% and 7.15%). Equivalently, income inequality slightly decreased between 2004 and 2010 (Gini index4 from 31.9 to 31.5) and the Human Development Index5 slightly increased (from 0.63 in 2005 to 0.68 in 2010).

Nevertheless, the demographic shock – between 1966 and 2011, the population jumped from 30 million inhabitants to 80 million – has created an important burden for the government to finance the social security system (Giesing and Musić, 2019). Due to its communist past, this system is fairly well developed, as the state subsidies, for instance, food and fuel and covers a large part of health insurance. The quality of these services has somewhat deteriorated as a consequence of the demographic shock, as well as the high level of corruption.

Table of contents :

Introduction

1.1 Motivation

1.2 Some stylized facts on demand for redistribution across the world and across time

1.2.1 High levels of demand for redistribution in 2011-2014

1.2.2 A net increase of demand for redistribution compared to 1995

1.2.3 Inequality and of demand for redistribution evolutions: A puzzle

1.3 Literature Review on the determinants of preferences for redistribution

1.4 Thesis structure

2 Evolution of Demand for Governmental Redistribution in the Era of Growing Inequality: The Case of Germany

2.1 Introduction

2.2 Stylized facts and literature review

2.2.1 The Evolution of inequality in Germany between 1995 and 2016

2.2.2 The drivers of inequality trend

2.2.3 Literature on inequality and support for redistribution

2.3 Data

2.4 Descriptive statistics

2.5 Empirical strategy

2.6 Basic results

2.7 Heterogeneous analysis

2.7.1 Alesina’s Prediction on the convergence of preferences between East and West Germany

2.7.2 Convergence of preferences of most affluent towards those of the less affluent

2.8 Conclusion

3 The Effect of the Arab Spring on Preferences for Redistribution in Egypt

3.1 Introduction

3.2 Context: The Egyptian Revolution in 2011

3.3 Data and descriptive statistics

3.4 Empirical strategy

3.5 Empirical results

3.5.1 Determinants of preferences for redistribution

3.5.2 Effect of the Revolution on preferences for redistribution

3.6 Discussion and robustness checks

3.7 Conclusion

4 Like Parents Like Child? The Intergenerational Transmission of Pref- erences for Redistribution

4.1 Introduction

4.2 Data

4.3 The correlation between the redistributive attitudes of children and parents

4.3.1 Poor-redistributive attitudes

4.3.2 Rich-redistributive attitudes

4.3.3 Additional tests

4.4 Channels of transmission of preferences: direct socialization vs indirect socialization

4.4.1 The process of transmission of attitudes towards taxation on poor .

4.4.2 The process of transmission of attitudes towards taxation on rich .

4.5 Mediation analysis : Parent’s redistributive attitudes as confounders.

4.6 Conclusion

5 Conclusion