(Downloads - 0)

For more info about our services contact : help@bestpfe.com

Table of contents

1 General Introduction

1.1 Safe Assets Accumulation and International Capital Flows

1.2 Non-Linear Pattern of International Capital Flows

1.3 Savings, Capital Accumulation and International Capital Flows

1.4 Outline of Thesis

2 Global Imbalances with Safe Assets in a Monetary Union

2.1 Introduction

2.2 The model

2.2.1 The economic setting

2.2.2 Characterization of equilibrium

2.3 Safe Assets and Risk-sharing

2.4 International Capital Flows

2.4.1 Current Account

2.4.2 Net Foreign Assets

2.4.3 Cross-border capital flows and Productivity

2.5 Empirical Analysis

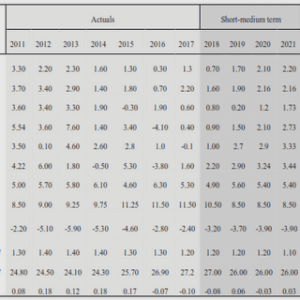

2.5.1 Descriptive Statistics

2.5.2 Evidences

2.6 Conclusion

Appendices

2.A Empirical analysis

2.B Proofs

2.C Extended model: Safe assets scarcity

2.D Extended model: Exorbitant privilege

3 Non-Linear Pattern of International Capital Flows

3.1 Introduction

3.2 Empirical analysis

3.3 Theory

3.3.1 Production

3.3.2 Consumption

3.3.3 Bank

3.3.4 Government

3.3.5 Equilibrium

3.4 International Capital Flows

3.4.1 Direction of International Capital Flows

3.4.2 Non-Linear Pattern of International Capital Fows

3.5 Conclusion

Appendices

3.A Data appendix

3.B Proofs

3.C Extended model: Public expenditure

4 Saving Wedge, Productivity Growth and International Capital Flows

4.1 Introduction

4.2 Saving wedge: Definition

4.3 Empirical evidences

4.4 Benchmark Model: Productivity growth and International capital flows

4.4.1 Production

4.4.2 Consumption

4.4.3 Government

4.4.4 Equilibrium

4.4.5 International capital flows

4.5 Long-run capital accumulation

4.6 Conclusion

Appendices

4.A Data Appendix

4.B Extended model: Public debt

4.C Extended model: capital flows in the club of convergence

5 General Conclusion