(Downloads - 0)

For more info about our services contact : help@bestpfe.com

Table of contents

1 General Introduction

1.1 Monetary macroeconomic theory

1.2 Empirical Monetary Macroeconomics

1.2.1 Monetary policy rules

1.2.2 Inflation dynamics

2 Introduction G´en´erale

3 Taylor Rules and Liquidity in Financial Markets

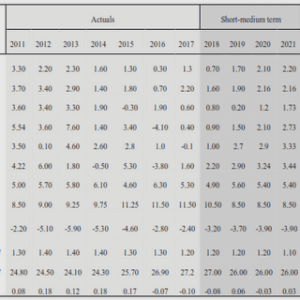

3.1 Data

3.2 Empirical Results

3.2.1 Specifications

3.2.2 Full sample analysis

3.2.3 Exogenous breaks

3.3 Diagnostics on Structural Breaks and Markov Switching

3.3.1 Markov Switching estimation

3.4 Conclusion

3.A Data Sources and Transformations

3.B Additional plots

3.C Empirical Appendix

3.C.1 Output gap

3.C.2 Full sample regression: residuals

3.C.3 GMM estimates

3.C.4 CUSUM test plots

4 A simple model with liquidity

4.1 A model with liquidity

4.1.1 Consumer

4.1.2 Firms

4.1.3 Monetary authority and market clearing

4.1.4 Linearised model

4.2 Calibration and IRFs

4.2.1 Liquidity with an accommodative central bank

4.3 Dissecting simulated inflation dynamics

4.4 The 2008 crisis: severe liquidity shortage

4.5 Conclusion

4.A Model appendix

4.A.1 Obtaining the system of equations

4.B Loglinearisation

4.C CIA setup

4.D Sensitivity analyses

4.D.1 Semi-elasticities for bonds and cash

4.E How g affects inflation dynamics

4.E.1 Misspecification

4.F Full lags structure

4.G Extreme policies

5 Inflation Persistence

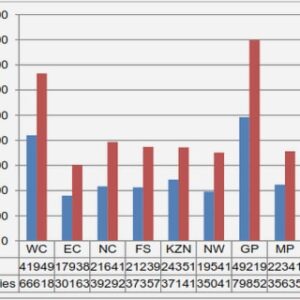

5.1 Data and tools

5.2 Autoregressive analyses

5.2.1 Optimal lags selection

5.3 A Bayesian estimation of inertia

5.4 RNN-LSTM approach to persistence

5.4.1 LSTM forecasting

5.4.2 LSTM setup

5.4.3 Full sample: forecasting inflation and its persistence

5.4.4 Regressions on LSTM

5.4.5 Rolling LSTMs

5.5 Conclusion

5.A A primer on the RNN-LSTM framework

5.B Year-on-year series

5.C Isolating oil and commodities’ inflation from headline

5.D Robustness with varying window width

5.E Draw distributions

5.F LSTM data and forecasts

5.F.1 LSTM predictions on non-overlapping subsamples

5.G LSTM analyses

5.G.1 OLS regressions on decades

5.H Trend estimates

5.H.1 Frequentist application

5.H.2 LSTM output: full sample

5.H.3 LSTM output: subsample analysis

5.H.4 LSTM output: rolling window

6 Conclusion

6.1 Policy Rules and Liquidity

6.2 Optimal Liquidity Management

6.3 Inflation Persistence

6.3.1 Macroeconometrics with Deep-Learning

6.3.2 Inflation and Structural Change