(Downloads - 0)

For more info about our services contact : help@bestpfe.com

Table of contents

Acknowledgement

Dedicace

List of tables

List of figures

Introduction

I. Theoretical review

Chapter introduction

I. 1- The resource curse hypothesis

I. 1-1. Economic explanation

I. 1-1-1.Dutch Disease

1-1-1-a. Gregory model

1-1-1-b. The core model: (Cordon and Neary 1982)

-1- The “Spending effect”

-2- The resource movement effect

1-1-1-c. The monetary effect: S.Edwards(1985)

I. 1-1-2. Procyclicality of fiscal policy

I. 1-1-3. Volatility of commodity prices

I. 1-2 Political and institutional view

I.1-2-1. Role of politics

a-Cognitive approach

b-Societal approach

c-Statist approach (state-centered explanation)

I.1-2-2 Institutional quality

I. 2- Oil price volatility issue

I. 2-1- The causes and effects of oil volatility

I. 2-1-1- The causes

a- Supply and demand for oil (market fundamentals)

b- Behavioral changes

I. 2-1-2 The effects of oil price volatility

a- Macroeconomic volatility

b- Volatility and growth

I. 2-2- Means to reduce volatility effects

I. 2-2-1 Fiscal policy

a- Oil funds

b- Fiscal rules and fiscal responsibility legislations

c- Budgetary oil price

I. 2-2-2 Role of financial development

I. 2-2-3- Role of economic diversification

Chapter conclusion

II. The empirical evidence

Chapter introduction

II. 1- Evidence on the traditional resource curse conundrum

II.2- Evidence on the volatility channel of the curse

II.3- Issues raised by empirical evidence

Chapter conclusion

III. The econometric study

Chapter introduction

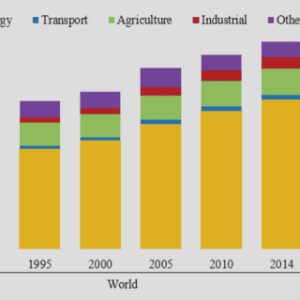

III.1- Oil economics in Algeria

III.1-1- Evolution of the oil sector

III.1-2- Management of oil revenues

III.1-3- Economic growth and oil revenues

III.1-4- The political and institutional environment

III.2- Data and Methodology

III.2-1- Description of the data

III.2-2- Methodology

a- An overview of the OLS estimation method

b- Methodology used in the study

III.3- The empirical results

Chapter conclusion

Conclusion and recommendations

References