Get Complete Project Material File(s) Now! »

CHAPTER 2 BUYING DECISION MAKING AND THE SOUTH AFRICAN ADVERTISING INDUSTRY

Introduction

Contemporary marketing thought appears to converge on the principle that understanding and retaining customers is critical for a firm’s long-term survival, innovativeness and bottom-line results (Agustin & Singh 2005). This view is resonant in the shift of the marketing discipline away from the study of marketplace exchanges as transactions that need to be consummated to that of exchanges as relationships that need to be nurtured, preserved and cultivated. Despite this emerging consensus, the discipline remains divided by the critical factors that can help a firm maintain and enhance customer retention.

Unlike an initial purchase decision, a firm’s renewal decision is much less likely to depend on contract specifications or marketing communications from suppliers (Bolton, Lemon & Bramlett 2004; Ganesh, Arnold & Reynolds 2000; Kalwani & Narayandas 1995). Previous research has also shown that competitive offerings are less important for a client’s repatronage decisions than initial purchases (Ganesh, Arnold & Reynolds 2000; Heide & Weiss 1995). This study and literature overview will therefore argue the importance of client retention as a strategic mandate in today’s service markets. It will further suggest that clients differ in their value to a firm, and that client retention efforts should therefore not necessarily be targeting all clients of a firm. In this chapter the relevant research context will be identified to delimit the scope of the study to include companies operating in a specified service sector in a business-to-business market environment. This study deliberately focuses on renewal decisions and specifically service contract renewal rather than initial purchase decisions. Like the seller of the service, this study does not observe the firm’s decision-making process within the organization. It simply observes the client’s choice between two primary alternatives, to renew or not to renew a contract. This study doesn’t distinguish between the secondary alternatives available to the client if the service contract is not renewed. The client may switch to another supplier, rely on in-house service, or discontinue using service in this category due to changing needs. This chapter will provide rationale for this delimitation.

Chapter Three will consider consumer behaviour, the social exchange theory and inter-organisational exchange behaviour in order to identify antecedents relevant to the buyer’s consideration set applicable to supplier contract renewal.

The Market Environment

As with most organizational processes, the nature and practice of marketing has evolved over recent decades. The academic field has also developed considerably, to provide a fuller understanding of the complexities of marketing practices in different types of firms and market contexts (Coviello, Brodie, Danaher & Johnston 2002). This led to the emergence of a number of classic dichotomies used in marketing. Such dichotomies suggest that marketing practice is ‘different’ for firms with different types of customers (e.g. consumer vs. business), different market offerings (e.g. goods vs. services), different geographical scope (e.g. domestic vs. international), or different size and age characteristics (e.g. small vs. large, or newer vs. more established firms) (Coviello & Brodie 2001).

The various market environments in which firms operate present uniquely different circumstances, which should be considered in marketing research. This research study will report on the South African advertising industry and will consider different size and age characteristics (as captured in firm demographic data) but will limit customer types and market offerings. The latter two dimensions warrant a literature overview in order to illustrate differences in these dichotomies and provide support for the selection of customers and offerings used in this study.

Consumer versus Business-to-Business

Markets The dichotomy of consumer markets (b2c)/business-to-business (b2b) markets essentially argues that b2b markets are different from b2c markets along a number of dimensions. This section will give an overview of these dimensions and argue that customer retention is an important strategic consideration for b2b firms.

A number of theoretical works argue that b2b markets are different from consumer markets (Ames 1970; Cooke 1986; Lilien 1987; Webster 1978). By definition, business markets are firms, institutions or governments that require goods and services either for their own use, to incorporate into products or services that they produce, or for resale along with other products and services to other firms, institutions, or governments (Anderson & Narus 2004). Consumer markets, in contrast, could be defined as consumers who purchase goods and services for their own use or for gifts to others. Consumer goods could be classified as either fast moving consumer goods (FMCG) or durable goods. FMCGs are products that are sold quickly at relatively low costs compared to consumer durables that are not destroyed by use and used for several years, such as vehicles, appliances, or furniture. Consumers include both individuals and households that make purchases to satisfy their needs and wants, solve their problems, or improve their lives (Churchill & Peter 1998).Literature supporting the dichotomy rests on the conceptual argument that b2b market characteristics and influences, buyer decision processes and buyer seller relationships differ from those found in consumer markets (Coviello & Brodie 2001) as illustrated in Table 2.1. It is important to note that characteristics, listed in table 2.1, range amongst a continuum of possibilities as determined by product/service type. Table 2.1 considers four types of offerings i.e. pure fast moving consumer goods (FMCG), consumer durables, industrial goods and services. The organisational buyer normally deals with far fewer, much larger buyers than the consumer marketer do. Although some b2b goods and services are inexpensive and relatively low risk such as minor stationery items including pens, pencils, staples, paper (goods) and copier repair; delivery of office supplies and outsourcing custodial security or cafeteria services (services), many business-to-business goods and services have a high transaction value and are driven by an accountable purchasing process (Bennett, Härtel & McCollKennedy 2004).

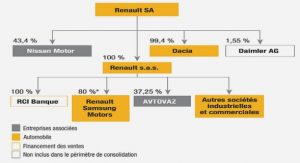

The role and importance of relationships in b2b and services marketing is well recognised in the literature (Coviello, Brodie, Danaher & Johnston 2002; Wilson, Zeithaml, Bitner & Gremler 2008). Because of the smaller customer base and the importance and power of the larger customers, suppliers are frequently expected to customise their offerings to individual needs (Kotler & Keller 2006) which lead to close supplier-customer relationships. The loss or gain of one customer could have an exceptionally important impact. In the case of advertising agencies small customer numbers are indicative of this industry and most agencies serve a limited number of customers. Income distribution of agencies mostly adheres to the Pareto principle as a few customer accounts represent a high concentration of revenue (Ad Focus 2006a and 2007a; Datamonitor 2005; Nielsen Media Research 2005). Consider, for example, the media spending of five major accounts served by Ogilvy South Africa, a South African advertising media agency. SABMiller spent R223,1 million, KFC spent R143,1 million, MultiChoice spent R95,3 million, Sun International spent R44,5 million and Eskom spent R33,7 million on main media advertisements in 2005 (Ad Focus 2006b). Ogilvy South Africa was named the top advertising agency for 2005 and has an impressive list of 57 accounts (Turkington 2006). Considering the income distribution of this agency, the loss of any of the mentioned accounts would have a significant influence on both the reputation and revenue of this company. Other agencies are even more dependent on customer retention as small customer numbers are indicative of this industry. Companies selling mass consumer goods and services such as soft drinks, cosmetics and athletic shoes spend a great deal of time trying to establish a superior brand image. Much of the brand’s strength depends on developing a superior product and packaging, ensuring its availability, and backing it with engaging communications and reliable service (Kotler & Keller 2006). Companies selling business goods and services, on the other hand, often face well-trained and well-informed professional buyers who are skilled in evaluating competitive offerings. These buyers are expected to adhere to their organisations’ purchasing policies, constraints, and requirements. Advertising can play a role in brand salience and communication, but a stronger role may be played by the sales force, price, and the company’s reputation for reliability and quality (Kotler & Keller 2006).

In b2b markets business buying decisions are typically influenced by many people. Buying committees consisting of technical experts and even senior management are common in the purchase of major goods (Kotler & Keller 2006). In business markets compared to the consumer packaged goods contexts, vendors tend to allocate greater proportions of their sales and marketing resources at the level of individual customers. Relationships are often close and enduring and achieving a sale is not the fulfilment of an effort but rather an event in a broader endeavour to build and sustain a long-term relationship with the customer (Gounaris 2005). These vendors strive to move from transactional relationships to more collaborative relationships. Retention is thus an important strategic consideration. For these reasons this research will consider firms operating in the b2b market and not the b2c market. 2.2.2 Buying Decision Approaches A key to success in business-to-business markets is the understanding of customer buying behaviour. Such understanding is difficult to achieve however, because the organisational buying process is often dynamic and complicated (Bunn 1993). Decision-making usually involves many people with varying degrees of interaction and is driven by individual and organizational goals. In the industrial markets, buying tasks also take place in the context of a formal organisation constrained by budget, cost, and profit considerations (Lau, Goh & Lei 1999). Buyers face a complex set of issues and their behaviours are confounded by many situational factors (Bunn 1993). Certain aspects of a firm’s buying situation, such as situational characteristics, buying activities and structural arrangements may influence how consideration and switching are performed and thus impact on customer retention.

Descriptions of Buying Decision

Approaches Bunn (1993) used an empirically based taxonomy development procedure to develop a classification scheme of buying patterns and situations (table 2.2). This classification scheme is useful to illustrate the buying patterns and situations relevant to this study. The taxonomy identifies six different types of buying decision approaches i.e. causal, routine low priority, simple modified rebuy, judgemental new task, complex modified rebuy and strategic new task. According to Bunn (1993) the use of a particular buying decision approach depends on four situational characteristics, namely purchase importance, task uncertainty, extensiveness of choice, and perceived buyer power. A mix of underlying buying activities distinguishes the categories. These are search for information, use of analysis techniques, focus on proactive issues, and reliance on control mechanisms as illustrated in table 2.2.

The focus of this research study would be buying decision approaches applicable to “complex modified rebuy” as highlighted in table 2.2. The complex modified rebuy is characterized as quite important with little uncertainty, much choice, and a strong power position. The approach in this situation is distinct in its resemblance to the normative decision making model. Buyers use all the activities in a structured and seemingly rational process. They search for a great deal of information, apply sophisticated analysis techniques, give due consideration to long term needs and supply, and closely follow established control mechanisms (Bunn 1993). For a discussion of the other buying decision approaches see Bunn (1993). Situational characteristics and buying activities, however, warrant further discussion. a. Situational characteristics A greater understanding of the categories of buying decision approaches can be achieved by considering the characteristics of the

situations in which the mixes of buying activities took place (Bunn 1993). Based on an extensive literature review Bunn (1993) have identified four relevant situational characteristics namely, (1) purchase importance, (2) task uncertainty, (3) extensiveness of choice set, and (4) perceived buyer power. These characteristics can also determine the level of dependency as illustrated in Chapter Three.

Purchase importance has been defined conceptually in terms of the “impact of a purchase on organizational operation, profitability and productivity” (Lau, Goh & Lei 1999: 578). Empirical evidence indicate that the importance of the purchase may influence many aspects of the decision process, such as the size and structure of the choice centre (Johnson & Bonoma 1981; Moriarty & Bateson 1982; Lau, Goh & Lei 1999) as well the perceived influence of the decision participants (Lau, Goh & Lei 1999; McQuiston 1989). The greater the importance of the purchase, the more technical the analyses of the offering and suppliers available, and the greater the involvement of specialized personnel from various departments and divisions required in the purchase decision (Lau, Goh & Lei 1999). Bunn (1993:41) defines this concept as “the buyer’s perception of the significance of the buying decision in terms of the size of the purchase and/or the potential impact of the purchase on the functioning of the firm.” This is an important consideration with the appointment of an advertising agency and will be considered in the research design.

Uncertainties surrounding tasks of organizational decision making have long been recognized as determinants of variations in the decision process (Galbraith 1977; Lau, Goh & Lei 1999; McQuiston 1989; Spekman & Stern 1979; Thompson & Tuden 1959). In fact, today industrial purchasers are encountering greater uncertainty as a result of a rapidly evolving purchasing environment where change is considered the only constant. This uncertainty can be thought of as the likelihood that the purchase of the product will lead to undesirable consequences (Lau, Goh & Lei 1999). Task uncertainty can be defined as “the buyer’s perceived lack of information relevant to a decision situation” (Bunn 1993:42). In this research setting, existing or prior relationships will be investigated which implies a degree of knowledge. New decision makers, markets and/or technology may, however, increase uncertainty and should be taken into account.

The scope of choices facing a decision maker will also influence the decision process (Bunn 1993) as discussed in more detail in Chapter Three. The extensiveness of choice set is defined as “the number of alternatives that are potentially able to meet the purchasing need” (Hunter, Bunn & Perreault Jr. 2006:158)

In addition to available choices, research on channel relations can also be useful when thinking about buyer-seller relationships. Buyerseller relationships in many industries suffer from severe dependencies between business operations. These dependencies could lead to the necessity of cooperation and coordination between companies’ business operations in order to achieve internal, and in some cases, mutual goals (Svensson 2004), thus influencing the buying decision process. Buying power can be defined as “the profitability and attractiveness of a sale to the buying firm by one or more suppliers and the suppliers’ desire for the customer’s business” (Hunter, Bunn & Perreault Jr. 2006:158).

As the above situational characteristics can influence the buying decision process, it should be considered pertinent to this research. b. Buying activities Bunn (1993) identified four underlying dimensions of buying activities, namely: (1) search for information, (2) use of analysis techniques, (3) proactive focusing, and (4) procedural control.

Search for information refers to the assembling and sorting through information that is central to management activity and is particularly relevant to buying decisions. It can thus be defined as “the buyer’s effort at scanning the internal and external business environment to identify and monitor information sources relevant to the focal buying decision” (Hunter, Bunn & Perreault Jr. 2006:157).

Numerous analysis tools are useful for evaluating different aspects of buying decisions (Chan 2003; Tseng & Lin 2005; Vokurka, Choobineh & Vadi 1996). Conceptually, buyers use analysis techniques to bring structure to the mass of information available to try and address rationally the issues surrounding the procurement. Bunn (1993:42) defines this underlying activity as “the extent to which the buyer makes use of formal and/or quantitative tools to objectively evaluate aspects of the buying decision”.

Proactive focusing is relevant to aspects of the decision process such as forecasting, contingency planning, and maintaining good relationships. Bunn (1993:43) defines this concept as “the extent to which decision making, related to the focal purchase, is prospective and thus considers the strategic objectives and long-range needs of the firm”. This activity will be considered as part of the exchange relationship discussed in Chapter Three.

The use of established procedures varies across different buying situations. For routine purchases buyers may either apply company control mechanisms or rule of thumb, based on past practice. The decision precedent may thus be formal or informal (Bunn 1993). Procedural control is defined as “the extent to which the evaluation of a buying decision is guided by previous experience – including established policies, procedures, or transaction norms” (Hunter, Bunn & Perreault Jr. 2006:157).

These four constructs seem to capture much of what buyers actually do when making purchase decisions and should thus inform the research design.

c. Structural arrangements A number of specific individuals or departments might be involved in purchasing decisions, and a number of individuals can be expected to play a role. Trying to sort out the various people involved in the buying decisions can become a great challenge (Morris, Pitt & Honeycutt 2001). When a single person makes a purchase decision for an organisation, the decision is said to be autonomous. When more than one person is involved, the group of participants in the company is called the buying centre or decision-making unit (Dwyer & Tanner 2001). Buying centre structures do differ from firm to firm as well as from one product/service to another. Furthermore, within the same firm, different buying centres may also have varying internal structures (Lau, Goh & Lei 1999).

Centralisation and formalization of the buying process refer to the nature of the buying process used (Heide & Weiss 1995). Formulisation is the extent to which purchasing tasks are formally prescribed by rules, policies, and procedures to be adhered to (Lau, Goh & Lei 1999). With regard to centralization, it is the distribution of formal control and power within an organization (Lau, Goh & Lei 1999). A high degree of centralization is usually typified by a concentration of power and control among relatively few organizational members, probably at upper management levels. Conversely, a low degree of centralization is characterized by a diverse distribution of power (Lau, Goh & Lei 1999).

TABLE OF CONTENTS

Declaration

Acknowledgements

Summary

CHAPTER 1 RESEARCH ORIENTATION

1.1 Introduction

1.2 Background to the Research

1.3 Research Scope

1.4 Research Context

1.5 Research Objectives

1.6 Investigative Questions

1.7 Chapter Outline

1.8 Conclusion

CHAPTER 2 BUYING DECISION MAKING AND THE SOUTH AFRICAN ADVERTISING INDUSTRY

2.1 Introduction

2.2 The Market Environment

2.3 Conclusion

CHAPTER 3 INTERORGANISATIONAL EXCHANGE BEHAVIOUR

3.1 Introduction

3.2 Customer Retention

3.3 Inter-Organisational Exchange Behaviour

3.4 Social Exchange Theory

3.5 Conclusion

CHAPTER 4 CONSIDERATION SET FORMULATION

4.1 Introduction

4.2 Consideration Set Formulation

4.3 Choice Set Size

4.4 The Conceptualisation of a Consideration Set Suitable for the Advertising Industry

4.5 Conclusion

CHAPTER 5 RESEARCH METHODOLOGY

5.1 Introduction

5.2 Research Scope

5.3 Research Strategy

5.4 Data Analysis

5.6 Conclusion

CHAPTER 6 QUALITATIVE INSIGHT

6.1 Introduction

6.2 Insight about the Advertising Industry

6.3 Identification of Clients to Retain

6.4 Client Defection Measurement

6.5 Drivers of Client Retention

6.6 Measurement Items

6.7 Conclusion

CHAPTER 7 QUANTITATIVE DATA ANALYSIS

7.1 Introduction

7.2 Section 1 – Respondent and Industry Information

7.3 Section 2 – Consideration Set Formulation

7.4 Section 3 – Agency Compliance to Advertisers’ Expectation s and Appointment Criteria

7.5 Conclusion

CHAPTER 8 CONCLUSIONS, LIMITATIONS AND FUTURE RESEARCH

8.1 Introduction

8.2 Advertising Agency Appointment

8.3 Retention: An Integrated and Holistic Perspective

8.4 Implications for Practitioners 8.5 Academic Implications

8.6 Limitations

8.7 Future Research

LIST OF REFERENCES

GET THE COMPLETE PROJECT

THE EVALUATION OF BUSINESS RELATIONSHIPS FROM THE BUYER’S PERSPECTIVE: ANTECEDENTS TO THE CONSIDERATION SET FOR SUPPLIER REPLACEMENT IN THE SOUTH AFRICAN ADVERTISING INDUSTRY