Get Complete Project Material File(s) Now! »

Research Design

The research design is”…the blueprint for the collection, measurement and analysis of data…” (Phillips, 1971). It is”… the plan and structure of investigation so convinced as to obtain answers to research questions…” (Kerlinger, 1986)

The design of the research should be relevant to the underlying research problem. The research problem addressed in this thesis concerns the effect the financial instruments accounting practices have on de facto harmonization and comparability. Therefore the research design can be shaped by the following descriptors (Blumberg, et al., 2003, Ghauri & Gronhaug, 2002):

1) The research is designed to conduct a formal study starting with a research question and hypotheses, collecting relevant data and testing hypotheses to answer the research question.

2) An ex post facto design is employed where the researcher has no control over the variables of the study and the results are merely documentation of what is observed in the actual environment circumstances.

3) In terms of topical scope, the research is a statistical study where a sample is drawn to infer to the population and hypotheses are quantitatively tested.

4) The existence of real environment conditions rather than manipulated ones implies that the research is a field study research rather than a laboratory research. This is apparent in conducting the study in Sweden where the IFRS financial instruments accounting standards are adopted.

5) The research encompasses both inductive and deductive approaches. The tendency to move from specific observations and measures to generalizations seeking to formulate a theory about the effect of the financial instruments accounting practices proposed under the IFRS on the comparability of financial reporting is an inductive process. Deduction occurs when the hypotheses are tested to confirm or reject the proposed effect of the independent variables (the IAS 39 accounting practices) on the dependent ones (material harmonization and comparability).

Research Approach

Since the research nature and question drive the research design (Blumberg, et al., 2003), therefore the research design requires the selection of a relevant approach to answer the underlying research question.

The current research is an empirical study of the effect of certain accounting choices on a particular process and a quality of accounting information. The empirical study “…should be fundamentally rotted in theory and it is impossible to conduct such research in a meaningful way without the researcher taking a theoretical standpoint” (Remenyi, et al., 2000), therefore in the sense of empiricism the research collects observations of the different accounting choices selected by different companies in the sample, quantifies the collected observations and analyzes them statistically. This is combined with the relevant provisions of the IAS 39, the surrounding theories and writings of other authors being clarified, analyzed and criticized from a theoretical perspective. This combination of both empirical and theoretical models is relevant to the nature of the research, where assessing the impact of accounting policies on de facto harmonization and comparability requires deeply reviewing both the independent and dependent variables in terms of related standards and relevant literature ( a theoretical standpoint) and measuring the degree of effect by quantifying the observations and running an industrial economic model and a statistical model( an empirical standpoint).

This empirical research is an uncontrolled interventions positivist approach. Remenyi, et al. (2000) argued that positivism is a form of the empirical approach that quantifies observations, expresses models in mathematical terms and runs a statistical analysis. This positivist approach has three strategies: passive observation, uncontrolled interventions and deliberate intervention. The uncontrolled intervention is the one that is employed when the researcher seeks to assess the effect of a change in an independent variable in the environment on one or more dependent variables. This strategy may require investigating the effect both before and after the event.

Though Remenyi, et al. (2000) argued that in an uncontrolled intervention positivist approach, the event should be studied both before and after it is intervened, however the ex ante effect is delimited in the scope of this research and only an ex post effect is studied. This could be relevant to the nature of the research, because the research objective is to investigate the effect on the process of material harmonization after the introduction of the new standards rather than a comparison between the effect under the old and new applicable standards. It is an IFRS based research that assesses the impact on the state of harmony and the process of harmonization under the IFRS environment in Sweden, rather than its development or deterioration over time. Therefore a post event study is the relevant one that matches the nature of the current research.

Sample Selection

The application of this research requires a selection to be made on three levels: 1- The accounting period: since the IFRS was obligated in the consolidated financial statements of listed companies from 2005, therefore a choice had to be made among the financial years 2005, 2006 and 2007.

The financial year 2005 was the first year for applying the IFRS in most consolidated financial statements of listed companies. The first time adoption of the standards and the transition from the previously applied standards to the IFRS might have an effect on the results, and since the research was not aimed to measure the degree of harmonization in the transition period, this year was not selected.

The choice was therefore limited to the financial years 2006 and 2007 because the annual reports of 2008 had not yet been issued when the study was conducted. The IFRS 7 financial instruments: disclosures had an effective date for annual periods after 1 January 2007. The standard requires more disclosures related to financial instruments and its principles are complementary for the principles of recognition and measurement of financial instruments in IAS 32 and IAS 39 (IFRS 7.1).This fact led to the selection of the financial year 2007.

2- The industry sector: the objective of this study is to determine the effect on harmonization and comparability. The comparability of financial reporting is seen from a sector basis, because to be comparable the same accounting methods are to be used in the same industry. Ten industry sectors were identified in NASDAX Stock Exchange: Energy, materials, industrials, consumer discretionary, consumer staples, health care, Financials, information technology, telecommunication services, and utilities. The utilities sector was excluded because no companies in this sector were traded in the Stockholm Exchange.

Two sectors have been chosen, the financials and industrials. The financial sector contains companies in the field of banking, brokerage, finance, investment banking, corporate lending, financial investment or real estate (Omx Nordic Exchange, 2008). Such activities require heavy use of financial instruments and hedging. This will lead to more financial instruments accounting practices to be employed and set the need for comparability in financial reporting on a high priority. The industrial sector contains companies involved in activities as the manufacture and distribution of capital goods, commercial services and transportation services including airlines and marine.

In 2007, the industrials had the highest number of companies traded on Stockholm Exchange comparing to other sectors. Around 25 % of all companies listed in NASDAQ Stock Exchange, Stockholm in 2007 were industrial. The sector companies also occupied the highest proportion in terms of large cap segmentation after the financial sector, and the highest proportion in the mid cap (Omx Nordic Exchange, 2008)

Besides the magnitude of the capital traded in the industrial sector, the activities in which the companies are involved in require the use of financial instruments including derivatives. The degree of harmonization and comparability is also of great importance to this sector interested investors.

Sampling Approach

Sampling techniques are categorized into probability sampling and non-probability sampling. Ghauri and Gronhaug (2002) pointed out to the drawbacks of non-probability sampling because they could be unrepresentative of the population and not valid in statistical analysis and hypotheses testing, therefore they may be more relevant in a qualitative research when a phenomenon is studied. The authors recommended the use of probability sampling when the aim is to evaluate unknown parameters and generalize the results to the population.

The population in the current study is the companies listed in NASAQ Stock Exchange, Stockholm at the end of 2007 in both the financial and industrial sectors. Each sector has three segments: Large cap, mid cap and small cap, and different companies are included in each of these segments.

A proportional stratified probability sampling approach is used on two levels. The first level is to equally divide the parent population into two mutually exclusive strata: the financials and the industrials. The second level is to break down each stratum- the financials and the industrials-into three strata: large cap, mid cap and small cap according to a proportion based on the relative population size of each stratum. The last step is to extract a simple random sample from each second level stratum. Riley, et al. (2000) wrote that the stratified sampling technique aims to ensure that the sample selected from the population is highly representative.

Ghauri and Gronhaug (2002) pointed out to the high precision given by the use of this technique and its ability to decrease the standard error of estimates. This is relevant to the current study because the statistical model used doesn‟t take into account the standard error, though this standard error has been considered as negligible for the applicable model by Taplin (2003), a reduction in its effect will also contribute to the external validation of the research.

Riley, et al. (2000) wrote that the sample size determination is a matter of judgment based on cost benefit analysis in terms of cost and time consumption against desired accuracy and aim of the study. The authors argued that there are no hard rules of how large the sample size is to be, and related it to other factors of costs and benefits. Therefore a sample size of 50 companies was expected to be sufficient and was drawn from both the financial and industrial sectors combined.

Data and Evidence Collection

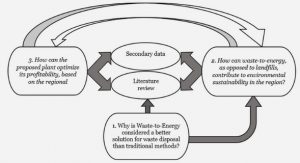

The financial statements published in the 2007 annual reports of the companies selected in the sample are the main source of data representing the inputs for the industrial economics and statistical models applied in the thesis. This kind of data is known as secondary data and was defined by Hair (2007) as “data used for research that was not gathered directly and purposefully for the project under consideration”.

The secondary data collected were obtained from each company included in the sample. The financial statements and a reasonable assurance of non-inclusion of material misstatements supported by an independent auditor are usually published in the annual reports in each company website. Since the interest is devoted to the selected accounting choices, the financial statements, their notes and supporting schedules and disclosures have been the targeted data. This sort of secondary data is termed as written materials documentary secondary data by Saunders, et al. (2007). Johnson and Christensen (2008) called this data written by organizations: official documents secondary data.

The documentary secondary data is advantageous as it can provide comparative and contextual data (Riley, et al. 2000).This privilege is relevant to the research study where the aim is to examine on a broad basis the selected accounting polices by different companies in the sample. Riley, et al. (2000) have also indicated the ability of secondary data when they are reanalyzed to result in unforeseen and unexpected discoveries. The discovery feature of secondary data is the core of this study where the annual reports published by the sample companies will be the inputs for the statistical methods used-without any intervention of the researcher-and the process may result in unexpected discoveries for the degree of harmony and comparability.

Since no other study identified has investigated the degree of de facto harmonization and comparability in Sweden after adopting the IFRS in the consolidated financial statements of listed companies, the results are ambiguous till the outputs of the models are obtained and analyzed. Though the analysis of the literature review tends to highlight some doubts concerning the degree of comparability under the standards, however the empirical evidence will have the last say in these controversial issues.

Research Statistical Analysis Methods

Two analysis tools are used to analyze the accounting practices identified in the consolidated financial statements of the sample companies which are Herfindahl (H) index and Chi square ( ). The harmonization literature proved that H index is the best harmonization measurement evidence provider. The use of Chi square was also recommended in the literature in the same kind of research where some researchers were criticized for basing their results only on the figures obtained from the index without a supporting test for significance. This study takes these critics into account and combines both methods to provide reasonably accepted evidence for the extent of comparability in financial reporting under the IFRS in Sweden.

Different versions of the H index were available in the literature. An entire chapter in the thesis addresses different measures of harmonization and different versions for each measure. The H index as proposed by Van der Tas (1988) and later applied by other researchers is the one used in this study. The model description and its application is clarified and run on the collected data.

Both the index and the significance test are applied on different accounting practice categories identified under the IAS 39. Each category of accounting practices had different probable outcomes because of some sort of flexibility left to managers to select their accounting policy choices. These probable outcomes were identified for each category and the frequencies of choices were gathered for each outcome. A sum of the frequencies for each outcome represented the number of companies selecting the same accounting method and was entered in both statistical instruments to measure the degree of harmonization and test for significance. This process was replicated for each sector in the sample; therefore both the financial sector and the industrial sector had received the same treatment when the data were analyzed.

Chi-square has also been used to test for associations between the selected accounting policy choices and the industry sectors. The parameter merely determines the possibility of an association; however it doesn‟t specify the sort of association.

The empirical finding is a pure analysis for what the figures obtained from each statistical tool mean and infer to, therefore a caution was taken when the data were collected, sorted and analyzed. The calculations were also reviewed because any error in the process might have a great impact on the results.

Time Horizon

This thesis aims to study the degree of harmonization and comparability affected by IAS 39 accounting practices in 2007. Since the study is a snapshot taken at a particular time, it is called a cross sectional study (Saunders, et al.2007).

The cross sectional study selection is the most appropriate here, because the degree of harmonization moves over time. The 2007 financial year is a critical year when the IFRS 7 became effective leading to more disclosures for financial instruments.

Instrumentation

When a research study is conducted, the study process involves measurement instruments selections. The study aims to employ the tools that are expected to provide the most precise measure of the variables. This calls for validity and reliability evaluation for the adequacy of the tools used in the study as they are the two most important criteria for assessing the research employed measurement instruments (Johnson & Christensen, 2008).

Validity

Lunenburg and Irby (2008) defined validity as the extent to which the measurement tools used in the study measured what they intended to measure.

Three forms of validity are assessed to reach the degree of validity for the instruments used in the study: content validity, criterion-related validity and construct validity.

Content validity or face validity is the outcome of the use of measurement tools that are generally accepted among experts as logically measure the intended content area (Zikmund, 1997). To reach this level of validity, the (H) index was used as a measurement tool because it was proved in previous studies as the best measure for the degree of de facto harmonization and therefore comparability. The studies that have criticized the use of the index have recommended the use of a significance test besides the index. Therefore the Chi square is used to test for the significant differences and to accept or reject hypotheses. The same combination of measurement tools has been used by other researchers in the same kind of research.

Criterion validity refers to whether the measurement instruments used correlates with other instruments that are used in the same construct (Zikmund, 1997). Since the use of the H index and Chi square complies with other studies in the literature aimed to measure the same attributes – de facto harmonization and comparability- in the same manner and vast numbers of researches in the harmonization literature combined the use of an industrial economic index and a test of significance, therefore the measurement tools selection provides a high degree of criterion validity. Construct validity is a function of both content validity and criterion validity. It deals with what is really measured by the instrument (Lunenburg & Irby 2008).The proposed high degree of both content validity and criterion validity is expected to be reflected in this form. Due to the fact that two different types of harmonization were distinguished in the literature – de jure and de facto – where each type had its proposed measurement tools, the instruments used in the underlying study comply with those commonly employed in measuring de facto harmonization and comparability. Therefore the measures used in the study were also used in earlier studies to measure the same concept of harmony and comparability of financial reporting.

Table of contents :

Chapter 1 Introduction

1.1 Introduction

1.2 Statement of the Problem

1.3 Objective of the Study

1.4 Hypotheses

1.5 Limitations

1.6 Delimitations

1.7 Structure of the Thesis

Chapter 2 Methodology

2.1 Introduction

2.2 Research Design

2.3 Research Approach

2.4 Sample Selection

2.5 Sampling Approach

2.6 Data and Evidence Collection

2.7 Research Statistical Analysis Methods

2.8 Time Horizon

2.9 Instrumentation

2.9.1 Validity

2.9.2 Reliability

2.10 Conclusion

Chapter 3 Financial Instruments Accounting under IFRS

3.1 Introduction

3.2 The Emergence of IFRS

3.3 The Adoption of IFRS in Sweden

3.4 The need for Financial Instruments Accounting

3.5 The scope of the Financial Instruments Accounting Standards under IFRS

3.6 The Nature of Financial Instruments

3.7 Recognition and De-recognition of Financial Instruments and consequences

3.7.1 Recognition of financial instruments

3.7.2 Transfer of Financial assets: De-recognition, Collateralized Borrowings or Continuing Involvement

3.7.3 Consequences

3.7.3.1 Trade date and Settlement date Accounting

3.7.3.2 Securitization: Financing and Accounting perspectives

3.7.3.2.1 A Financing perspective

3.7.3.2.2 An Accounting perspective

3.8 Measurement of financial instruments

3.8.1 Initial and subsequent measurement and the FV option

3.8.2 The Fair value considerations

3.9 Embedded derivatives and Fair value election:

3.10 Hedge Accounting:

3.10.1 Why Hedge Accounting?

3.10.2 Hedge Accounting models and Documentation:

3.11 Conclusion

Chapter 4 Accounting Practices, Harmonization and Comparability

4.1 Introduction

4.2 Accounting Practices

4.2.1 Accounting Standards and Accounting Practices

4.2.2 The Accounting Choice Research

4.2.3 Accounting Practices, the Financial Numbers Game and Earnings Management: Can the game still be played!

4.3 Harmony, Harmonization and Comparability

4.3.1 Harmony and Harmonization

4.3.2 Comparability

4.4 Accounting Harmonization Research

4.5 Main Quantitative Measures of Harmonization

4.5.1 Euclidean Distances

4.5.2 Jaccards Coefficients

4.5.3 The Herfindahl (H) index

4.5.4 (C) index

4.5.5 (I) index

4.5.6 Harmonization Measures Matrix

4.6 Conclusion

Chapter 5 Empirical Findings

5.1 Introduction

5.2 Tools of Analysis

5.3 Sampling procedures

5.4 Accounting practices and Possible Choices

5.5 Data Coding

5.6 Data analysis, Test results and Hypotheses Testing

5.6.1 Fair Value Option

5.6.2 Trade Date or Settlement Date Accounting

5.6.3 The FV Valuation Model in a Non-active Market

5.6.4 Transaction Cost Treatment

5.6.5 Embedded Derivatives Treatment

5.6.6 Mathematical Model for Hedge Effectiveness Test

5.7 Conclusion

Chapter 6 Discussion and Conclusions

6.1 Introduction

6.2 Summary of the Study

6.3 Discussion of the Findings

6.3.1 The Effect of FVO on De facto Harmonization and Comparability

6.3.2 The Effect of Trade Date and Settlement Date Accounting Choices on De Facto Harmonization and Comparability

6.3.3 The Effect of Looseness in the FV Model Selection on De facto Harmonization and Comparability

6.3.4 The Effect of the Ambiguity of TC Treatment Provisions on De facto Harmonization and Comparability

6.3.5 The Effect of FV Election of Compound Instruments on De facto Harmonization and Comparability

6.3.6 The Effect of the Looseness in the Hedge Effectiveness Test Models Selection on De facto Harmonization and Comparability

6.4 Implications of the Empirical Findings

6.4.1 The Diverse Accounting Practices and the management intention: Much effort is still needed!

6.4.2 Material Harmonization and Comparability: IAS 39-Is it a road to dis-harmony?

6.4.3 The Consequence of Mangers Selections and relatively low material harmonization: The question of financial stability!

6.4.4 The Industry Sector and Firms‟ Characteristics Factors

6.5 Suggestions for Future Research

6.5.1 Ways to Improve and Extend the Current Study

6.5.2 Recommendation for New Researchable Topics

6.6 Conclusion

References

Appendices

Appendix 1

Appendix 2