Get Complete Project Material File(s) Now! »

Theoretical Framework

We examine the impact of international trade on aggregate welfare and productivity in a general-equilbrium model with firm heterogeneity in productivity as in Melitz (2003) and Chaney (2008) and potential resource misallocation as in Bartelsman et al. (2013). We formalize the main theoretical results and provide intuition for the underlying mechanisms in this section, and relegate detailed proofs to Appendix A.

Our goal is threefold. First, we highlight that in the absence of resource misallo-cation, bilateral and unilateral export liberalizations always raise aggregate welfare and productivity, while unilateral import liberalization can have ambiguous effects. Second, we show that all three types of globalization have ambiguous consequences in the presense of misallocation. Third, we characterize the relationship between the concepts of welfare and productivity in the model and measures of firm and aggregate productivity in the data to provide a bridge between theory and empirics.

Set Up

Consider a world with two potentially asymmetric countries i = 1, 2.3 In each coun-try, a measure Li of consumers inelastically supply a unit of labor, such that aggre-gate expenditure is Ei = wiLi due to free firm entry into production. The utility of the representative consumer Ui is a Cobb-Douglas function of consumption of a ho-mogenous good Hi and a CES aggregate over consumption of available differentiated varieties z ∈ Ωi with elasticity of substitution σ ≡ 1/(1 − α) > 1: Ui = Hi1−β Qiβ , Qi = ��z∈Ωi qi(z)α dz� 1/α . (3.1)

Demand qi(z) for variety z with price pi(z) in country i is thus qi (z) = βEiPiσ−1pi(z)−σ, where βEi is total expenditure on differentiated goods and Pi = � z∈Ωi pi(z)1−σ dz�1/(1−σ) is an ideal price index. �

The homogeneous good is freely tradeable and produced under CRS technology that converts one unit of labor into one unit of output. It proves important to distinguish between two cases. When β is sufficiently low, both countries produce the homogeneous good, such that it serves as a numeraire that fixes worldwide wages to unity, wi = 1. We will refer to this case simply as β < 1. When β = 1 by contrast, only differentiated goods are consumed, and wages are endogenously determined in equilibrium.

In each country, a continuum of monopolistically competitive firms produce hor-izontally differentiated goods that they can sell at home and potentially export abroad. Firms must pay a sunk entry cost wifiE , 4 and should they commence production, fixed operation costs wifii and constant marginal costs as specified be-low. Exporting from i to j requires fixed overhead costs wifij and iceberg trade costs such that τij units of a product need to be shipped for 1 unit to arrive, where τii = 1 and τij > 1 if i =� j. We allow for τij =� τji, and will analyze symmetric and asymmetric reductions in τij to assess the impact of different trade reforms.

Firm Productivity and Resource Misallocation

In the absence of misallocation, firms in country i draw productivity ϕ upon entry from a known Pareto distribution Gi(ϕ) = 1 − (ϕmi/ϕ)θ, where θ > σ − 1 and ϕmi > 0. This fixes firms’ constant marginal cost to wi/ϕ. In the presence of resource misallocation by contrast, firms draw both productivity ϕ and distortion η from a known joint distribution Hi(ϕ, η). Firms’ marginal cost is now determined by their distorted productivity ϕ = ϕη and equals wi/ϕ = wi/(ϕη). For comparability with the case of no misallocation, we assume that ϕ is Pareto distributed with scale parameter ϕmi and shape parameter θ.

Conceptually, η captures any distortion that creates a wedge between the social marginal cost of an input bundle and the private marginal cost to the firm. Formally, this implies a firm-specific wedge in the first-order condition for profit maximization, as in Hsieh and Klenow (2009) and Bartelsman et al. (2013). Such a wedge may result from frictions in capital or labor markets or generally weak contractual institutions that support inefficient practices like corruption and nepotism.5 Distortions η will lead to deviations from the first-best allocation of productive resources across firms: If a firm can access ”too much” labor, this would be equivalent to a subsidy of η > 1. Conversely, capacity constraints would correspond to a tax of η < 1.

Modeling resource misallocation in this way has several appealing features. First, introducing distortions on the input side is isomorphic to allowing for distortions in output markets instead, such as firm-specific sales taxes.6 Our theoretical formula-tion thus ensures tractability without loss of generality. In the empirical analysis, we correspondingly exploit different measures of broad institutional quality, capital and labor market frictions, and restrictive product market regulations. Second, in our model misallocation describes the inefficient allocation of production resources and consequently market shares across firms in the differentiated industry, as well as across sectors when β < 1. Since the combination of CES preferences and monop-olistic competition will imply constant mark-ups, no additional misallocation arises from variable mark-ups across firms as in Dhingra and Morrow (2016).

Finally, the functional form for firms’ marginal costs permits a transparent com-parison of firm and economy-wide outcomes with and without misallocation. Under misallocation, firm selection, production and export activity depend on ϕ and η only through distorted productivity ϕ = ϕη, while optimal resource allocation in the first best depends on ϕ alone. Thus two parameters regulate the degree of misallocation: the dispersion of the distortion draw, ση, and the correlation between the distortion and productivity draws, ρ(ϕ, η).7 Misallocation occurs if and only if ση > 0, but its w�iτij severity need not vary monotonically in the ση − ρ(ϕ, η) space.8

Firm Behavior

We first characterize firms’ optimal behavior in the absence of resource misalloca-tion. Producers choose their sales price pij (ϕ) and quantity qij (ϕ) to maximize profits πij (ϕ) separately in each market j they serve. The problem of a firm with productivity ϕ and its first-best outcomes are thus: max πij (ϕ) p,q σ−1 −σ = pij (ϕ)qij (ϕ) − wiτij qij (ϕ)/ϕ − wifij s.t. qij (ϕ) = βEj Pj pij (ϕ(3).2) where lij (ϕ), cij (ϕ) and rij (ϕ) are the employment, costs and revenues associated with sales in j.

Since profits are monotonically increasing in productivity, firms in country i sell in country j only if their productivity exceeds threshold ϕ∗ij . The domestic and export cut-offs are implicitly defined by: rii(ϕii∗) = σwifii, rij (ϕij∗ ) = σwifij . (3.6)

We assume as standard that the parameter space guarantees ϕ∗ij > ϕ∗ii for any τij > 1. Along with consumer love of variety and fixed operation costs fii, this implies selection into exporting, such that no firm exports without also selling at home. In turn, firms commence production upon entry only if their productivity draw is above ϕ∗ii, and exit otherwise.

Following the same solution concept, we next determine firms’ constrained-optimal behavior in the case of misallocation. The profit-maximizing problem of a firm with distorted productivity ϕ = ϕη generates the following second-best outcomes: max πij (ϕ, η) = pij (ϕ, η)qij (ϕ, η) − wiτij qij (ϕ, η)/ϕη − wifij s.t. qij (ϕ, η) = βEj Pjσ−1pij (ϕ, η)−σ

While it would be socially optimal to allocate input factors and output sales based on true firm productivity ϕ, in the market equilibrium this allocation is instead pinned down by distorted productivity ϕ. Along the intensive margin, firms with low (high) distortion draws η produce and earn less (more) than in the first best, while charging consumers higher (lower) prices than efficient. Along the extensive margin, a highly productive firm might be forced to exit if it endures prohibitively high distortive taxes, while a less productive firm might be able to operate or export if it benefits from especially high subsidies. In particular, firms now produce for the domestic and foreign market as long as their distorted productivity exceeds cut-offs ϕ∗ii and ϕ∗ij , respectively: rii(ϕ∗ ) = σwifii, rij (ϕ∗ ) = σwifij . (3.11)

General Equilibrium

The general equilibrium is characterized by equilibrium conditions that ensure free entry, labor market clearing, income-expenditure balance, and international trade balance in ach country. Consider first the case of no misallocation. With free entry, ex-ante expected profits must be zero:

j E πij (ϕ)I(ϕ ≥ ϕij∗ ) = wifiE ⇐⇒ (3.12) where E[•] is the expectation operator and I(•) is the indicator function.

A key implication of the free-entry condition is that the productivity cut-offs in country i for production and exporting must always move in opposite directions following trade reforms that affect τij or τji. Intuitively, any force that lowers ϕ∗ij tends to increase expected export profits conditional on production. For free entry to continue to hold, threshold ϕ∗ii must therefore rise, such that the probability of survival conditional on entry falls and overall expected profits from entry remain unchanged.

When β < 1, wages are fixed and pinned down in the homogeneous-good sector. When β = 1, by contrast, wages are flexible and determined by labor market clearing in the differentiated-good sector: Li =j MiE �lij (ϕ)I(ϕ ≥ ϕij∗ )� + MifiE , (3.14) where Mi is the mass of entering firms in country i.

In equilibrium, aggregate consumer income Ej must equal aggregate expenditure in the economy. With free entry, aggregate corporate profits net of entry costs are 0, such that total income corresponds to the total wage bill. Consumers’ utility maximization implies the following income-expenditure balance: βEj = βwj Lj =i Rij =i MiE �rij (ϕ)I(ϕ ≥ ϕij∗ )� , (3.15) where Rij is aggregate spending by consumers in country j on differentiated varieties from country i.9,10

Consider next the case of resource misallocation. The free entry and labor market clearing conditions are analogous to those above after replacing productivity ϕ with distorted productivity ϕ = ϕη. The income-expenditure balance, however, has to be amended to account for the implicit dead-weight loss of misallocation. While firm (ϕ, η) incurs production costs c (ϕ, η) = w fij + τij qij (ϕ,η) , the associated payment � ij i �τij qij (ϕ,η) ϕη � � received by workers is cij (ϕ, η) = wfii �fij + �. The gap cij (ϕ, η) − cij (ϕ, η) fi ϕ is the social cost of distortionary rm-speci c taxes or subsidies on labor costs, which we assume is covered through lump-sum taxation of consumers in i. The new 9When β = 1, general equilibrium requires an additional condition for balanced trade in the differentiated-goods sector that implicitly links productivity thresholds and relative wages across countries: iRik =j Rkj .

10With an exogenous mass of firms, the free entry condition is moot, and the labor market clearing condition reduces to Li =j MiE lij (ϕ)I(ϕ ≥ ϕ∗ij ) . Since aggregate corporate profits Πj are no longer 0, the income-expenditure condition becomes βEj = β(wj Lj + Πj ). This condition also directly guarantees balanced trade when β = 1. See Appendix B. equilibrium conditions become:

j E �πij (ϕ, η)I(ϕη ≥ ϕ ij∗ )� = wifiE , (3.16)

Li =j MiE �lij (ϕ, η)I(ϕη ≥ ϕ ij∗ )� + MifiE , (3.17)

βE j = β(w L j − T ) = i Rij =i MiE rij (ϕ, η)I(ϕη ≥ ϕ∗ ) , (3.18)

j j � ij �

Ti = � ϕ ∗ . (3.19)

j MiE �[cij (ϕ, η) − cij (ϕ, η)]I(ϕη ≥ ij )�

Welfare

Welfare in country i is given by real consumption per capita and can be expressed as: (1 − β)1−βββ wi χ i Wi = Piβ Up to a constant, welfare is thus proportional to the real wage, wi/Piβ , and the ratio of disposable income to gross income, χi. In the absence of misallocation, all income accrues to worker-consumers, such that Ei = wiLi and χi = 1. In the presence of misallocation, by contrast, some income is not available to consumers due to the dead-weight loss of distortions, such that Ei = wiLi − Ti.11

One can show that the real wage, and therefore also welfare, is a function only of model parameters (market size Li, fixed production costs fii, and demand elasticities β and σ) and two endogenous equilibrium outcomes: the (distorted) productivity cut-off for domestic production, ϕ∗ii or ϕ∗ii, and the ratio of disposable to gross income, χi. This is summarized by the following lemma and proportionality condition:12 Lemma 1 Without misallocation, welfare increases with the domestic productivity cut-off, ddWϕ∗i > 0. With misallocation, welfare increases with the distorted domestic productivity cut-off, ddWϕ∗i > 0, and with the share of disposable income in gross income, dWi > 0. dχi

With efficient resource allocation, a higher productivity cut-off ϕ∗ii implies a shift in economic activity towards more productive firms, which intuitively tends to lower the aggregate price index and increase consumers’ real income. With misallocation, distortions affect welfare through the reduction in disposable income χi and through the sub-optimal selection of active firms based on distorted productivity ϕ rather than true productivity ϕ. A direct implication of Lemma 1 is that the welfare impact of trade liberalizattion depends on how a reduction in τij affects ϕ∗ii, ϕ∗ii, and χi.

From Theory to Empirics

A key challenge in empirically evaluating the gains from trade is that the theoretical concepts of productivity and welfare are not directly observed in the data. In this section, we show that measurement error and resource misallocation result in impor-tant disconnect between these theoretical objects and their measured counterparts that the literature typically ignores. This will closely guide our empirical design and interpretation.

Theoretical vs. measured firm productivity

The theoretical concept of firm productivity ϕ is quantity-based (TFPQ), while empirical measures Φi(ϕ) are generally revenue-based (e.g. TFPR or labor produc-tivity). We now show that the observed real value added per worker is an attractive choice for Φi(ϕ), and we therefore use it in the empirical analysis.

Observed value added corresponds to the theoretical notion of total firm revenues ri(ϕ) from domestic sales and any exports, where ri(ϕ) = j rij (ϕ)I(ϕ ≥ ϕij∗ ). l ϕ) that a firm hires to Observed employment represents the total units of labor i( � produce for home and abroad, li(ϕ) = j lij (ϕ)I(ϕ ≥ ϕij∗ ). Denoting labor used towards fi xed overhead and export costs as f (ϕ) = j f ij I(ϕ ≥ ϕ∗ ) and normalizing P fi productivity becomes: by the consumer price index i, measured rm �

r (ϕ) w f (ϕ)

Φi(ϕ) = i = i �1 − i � . (3.22)

Pili(ϕ) αPi li(ϕ)

One can show that conditional on export status, measured firm productivity in-creases monotonically with theoretical firm productivity, Φ�i(ϕ|ϕ < ϕ∗ij ) > 0 and Φ�i(ϕ|ϕ ≥ ϕ∗ij ) > 0. Note first that the ratio of sales to variable employment, ri(ϕ)/[li(ϕ) − fi(ϕ)], is invariant across firms with constant mark-ups, but this does not hold for sales to total employment, ri(ϕ)/li(ϕ), because of economies of scale. However, the measured productivity of firm ϕ based on domestic sales should it not export exceeds its measured productivity based on global sales should it export, rii(ϕ)/lii(ϕ) > ri(ϕ)/li(ϕ). This is due to a downward shift in the function Φi(ϕ) at the export productivity cut-off ϕ∗ij , because firms incur fixed export costs such that rii(ϕ∗ij )/lii(ϕ∗ij ) > rij (ϕ∗ij )/lij (ϕ∗ij ). Finally, observe that measured firm productiv-ity increases with the real wage, wi/Pi, and implicitly depends on the productivity thresholds, ϕ∗ii and ϕ∗ij .

Table of contents :

1 Résumé

2 Introduction

3 Productivity, (Mis)allocation and Trade

3.1 Introduction

3.2 Theoretical Framework

3.2.1 Set Up

3.2.2 Firm Productivity and Resource Misallocation

3.2.3 Firm Behavior

3.2.4 General Equilibrium

3.2.5 Welfare

3.2.6 From Theory to Empirics

3.2.7 Impact of Trade Liberalization

3.2.8 Numerical Simulation

3.2.9 Discussion

3.3 Data

3.3.1 CompNet Productivity Data

3.3.2 WIOD Trade Data

3.4 Trade and Aggregate Productivity: OLS Correlation

3.4.1 OLS Specification

3.4.2 OLS Results

3.5 Impact of Trade on Aggregate Productivity: IV Causation

3.5.1 The Endogeneity Problem

3.5.2 IV Strategy

3.5.3 Baseline IV Results

3.5.4 Sensitivity Analysis

3.5.5 Import Competition from China

3.6 How Trade Affects Productivity: Interpretation and Mechanisms

3.6.1 Firm Selection

3.6.2 Productivity Upgrading

3.6.3 Imperfect Institutions and Market Frictions

3.6.4 Misallocation Measures in the Literature

3.7 Conclusion

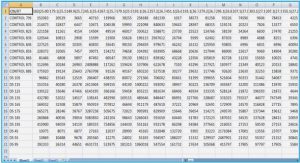

3.8 Tables and Figures

4 Input Prices, Allocation of Resources and TFP Growth: Evidence from Chinese Imports in France

4.1 Introduction

4.2 Theoretical Framework

4.2.1 Technology and firm behaviors

4.2.2 Sectoral production functions and aggregate TFP

4.3 Empirical framework

4.3.1 Data description

4.3.2 Estimation method of aggregate TFP

4.3.3 Heterogeneous impact of Chinese trade shock along firm size distribution: evidence from firm-level wedges

4.3.4 TFP growth and Chinese trade shock: OLS correlation

4.3.5 Impact of outsourcing in China on French TFP growth: IV causality

4.3.6 Robustness checks

4.4 Conclusion

4.5 Tables and Figures

5 Resource Misallocation in India: The Role of Cross-State Labor Market Reform and Financial Development

5.1 Introduction

5.2 Literature Reviews

5.3 Measuring Misallocation

5.4 Data and Stylized Facts

5.4.1 Firm-level balance sheet data

5.4.2 State and sector characteristics in India

5.4.3 Stylized facts

5.5 Econometric Analysis

5.5.1 Baseline regression

5.5.2 Links between labor market regulations and informality

5.6 Empirical Results

5.6.1 Regression results

5.6.2 Robustness check and scenario analysis

5.7 Conclusion

5.8 Tables and Figures

6 Conclusion

References

Appendices

A Productivity, (Mis)allocation and Trade

B Input Prices, Allocation of Resources and TFP Growth: Evidence from Chinese Imports in France 195

B.1 Exact decomposition of sectoral TFP

B.1.1 Dispersion of firm-level wedges as measure of sector-level misallocation

C Resource Misallocation in India: The Role of Cross-State Labor Market Reform and Financial Development

C.1 Alternative Measures of Misallocation

C.1.1 Variance of TFPR

C.1.2 TFP gap

C.2 Labor Market Regulations and Reforms in India