Get Complete Project Material File(s) Now! »

CHAPTER TWO LITERATURE REVIEW

Introduction

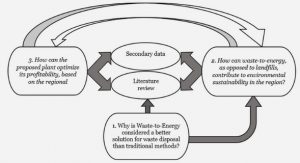

The previous chapter introduced the study and provided a background of the study problem. Various scholars, including those in Library and Information Science (LIS), agree that a review of literature is a necessity in an empirical study for various reasons. Dilevko (2007:451) attests that a review of literature provides key building blocks for good research. Its purpose is to share with the reader the results of other studies closely related to the one being undertaken. It also relates to the larger, ongoing dialogue in the literature, filling in gaps and extending prior studies (Creswell 2014:61-62). It provides a framework for establishing the importance of the study as well as a benchmark for comparing the results with other findings (Creswell 2009:25-27). According to Randolph (2009:2), literature review is a means of demonstrating an author’s knowledge about a particular field of study, including vocabulary, theories, key variables and phenomena, and its methods and history. It also informs students of the influential researchers and research groups in the field (Randolph 2009:2). Mertens (2010:90) explains that most of empirical studies are grounded on a review of literature from which the researcher is able to map the overall framework of the study at hand in terms of where it fits into the big picture of what is known about the topic from prior studies. Kumar (2005:30) states that from the inception of a study, it helps to establish the study’s theoretical roots, clarify ideas and develop one’s methodology. After data collection, the reviewed literature augments and consolidates the newly found knowledge base from findings and assists in the integration of findings with the existing body of knowledge.

This review of literature explores the central theme of this study, which is ensuring the authenticity of digital records in government accounting systems to support audit processes in the public sector of Botswana. It is organised in accordance with the research objectives of the study. It explores literature related to the context of the study with greater and specific focus on the legislative framework for the creation of authentic, reliable digital records, criteria used by auditors, ICT specialists and records managers to determine the authenticity and reliability of digital records created and stored through information systems, capabilities needed by auditors, ICT specialists and records managers to establish the authenticity and reliability of digital records created and stored in information systems and the management, preservation and storage of authentic, reliable digital records created and stored in information systems in support of audit processes in the public sector.

The Legislative Framework for the Management of Digital Records

Records should be managed through guidance of a specific regulatory framework, the purpose of which is to provide an environment that is conducive to proper records management. This includes managing records in a digital environment (ISO 15489 – 1: 2016:8; Bantin 2008:233; Okello-Obura 2011:6). Countries around the world have archival legislation that promotes the proper management of digital records; for example, Canada has the Library and Archives Act (Government of Canada 2004, amended in 2016), South Africa has the National Archives and Records Services Act (Government of South Africa 1996) and Sweden has the Archives Act (Anderson 2013:2). In most archival legislation, the definition of the word ‘records’ includes digital record. Botswana’s national archival legislation was amended in 2007 to include ‘digital record’ in its definition of a record (Ngoepe & Keakopa 2011:155). While Ngoepe and Saurombe (2016:29-30) acknowledge that the wide coverage of the definition of a record helps to ensure that as many forms of records as possible in as many media as possible are included, the legislation is still inadequate to deal with managing records in a cloud environment (Ngoepe & Keakopa 2011:155; InterPARES 2016:10). For example, Ngoepe and Saurombe (2016:29-30) conclude that as much as the Minister responsible for the archives and records management portfolio has the mandate to declare any place to be a place of deposit, the legislation is still inadequate in answering the following questions:

Does the Minister have the capacity to determine such suitability? What are the legal obligations of having such a declaration? Does the Minister and Director have a legal capacity to monitor the cloud, and if there are violations in the cloud, can they charge those responsible for such violations? (Ngoepe & Saurombe 2016:30).

According to Adu (2015:25), the introduction of a legislative framework within the public sector is part of a larger framework for the management of public records. These manifest in the form of Acts, legislation and policies that give clear direction to the management of public records. According to scholars such as Ngulube and Tafor (2006:60), Hamooya, Mulauzi and Njobvu (2011:116), Okello-Obura (2011), Kalusopa (2011:228) and Ngoepe and Saurombe (2016:24), public records management operates within a framework of laws. In Botswana, several legislative instruments are applicable to the management of records in the country. These are the National Archives and Records Services Act, Electronic Records (Evidence) Act, Electronic Communications and Transactions Act, Public Audit Act, Public Finance Management Act, National ICT Policy and e-Government Strategy.

National Archives and Records Services Act Cap 59:04 Of 1978

Most of the national archival legislation in the Southern African Development Community (SADC) was enacted after independence and modelled along the United Kingdom’s Public Record Act, in the case of Botswana in 1958, Portugal, former colonies, Mozambique and Angola (Mnjama 2014:30; Ngoepe & Saurombe 2016:29). Prior to the amendment of Botswana’s archival legislation in 2007 to formally extend its legal mandate to the management of public sector records across their life cycle (Ngoepe & Keakopa 2011:155; Manewe-Sisa, Mooko & Mnjama 2016:156; Ngoepe & Saurombe 2016:29), the archives legislation only covered archives administration (Government of Botswana 1978). Almost all the literature available points to the National Archives Act of 1978 as the one that established archives and records management services in the country (Mbakile 2004:11; Keakopa 2006; Moloi 2009:109; Ramokate & Moatlhodi 2010:68) as shown by the cited few.

As amended in 2007, the management of public sector records in Botswana is now regulated by the National Archives and Records Services Act (Government of Botswana 1978). Its scope includes the management of digital records. Although this legislation recognises digital records as part of national heritage when they are included as archives, there are no guidelines as to how digital records should be managed to ensure that their authenticity and integrity are maintained for as long as they are used. Ngoepe and Keakopa (2011:155), and Moatlhodi (2015:74) have also indicated that the National Archives and Records Services Act is inadequate to regulate the management and preservation of digital records-keeping systems. The Electronic Records (Evidence) Act provides for the admissibility of digital records as evidence in legal proceedings and authentication of digital records (Government of Botswana 2014a). Ngoepe and Saurombe (2016:30) observe that section 5 of this Act indicates that, where a digital record is obtained from a digital records system and duly certified as such by the certifying authority in relation to the operation or management of the approved process, it shall be presumed that it accurately reproduces the contents of the original records system.

Electronic Records (Evidence) Act

Through the recently superseded long-term vision for Botswana, the National Vision 2016 (Government of Botswana 1997), and the National ICT Policy (Government of Botswana 2007), the country promoted the use of ICTs, particularly web-based applications to enhance access to and delivery of government information and services to citizens, business partners, employees, other agencies and government entities (Mosweu 2012:6). However, Kalusopa (2008:106) notes that, by 2008, the government still lacked appropriate legislation to deal with the ICTs that its policies were instituting, despite the fact the ICTs generated digital records (Moloi 2009:110). In view of both the Criminal Procedure and Evidence Act (Government of Botswana 2004) and the Evidence in Civil Proceedings Act (Government of Botswana 1977) providing for the admissibility of documentary evidence (without provisions for digital records), a need arose for enacting legislation to enable evidence contained in digital records to be tendered as evidence before the courts (Ganetsang 2015), in the form of the Electronic Records (Evidence) Act (Keetshabe 2012; Government of Botswana 2014a).

Therefore, the Electronic Records (Evidence) Act was enacted to provide for the admissibility of digital records as evidence in legal proceedings and authentication of digital records (Government of Botswana 2014a). It also provides for the admissibility as evidence of digital records as original records. Ngoepe and Saurombe (2016: 30) observe that section 5 of this Act indicates that, where a digital record is obtained from a digital records system and duly certified as such by the certifying authority in relation to the operation or management of the approved process, it shall be presumed that it accurately reproduces the contents of the original records system. This legislation is well placed to promote the maintenance of digital accounting records. However, in the situation where GABS is not integrated with a digital records management system, maintaining the authenticity of digital accounting records within the system may be questionable, as GABS, although it produces and stores digital records, is not a purely digital records management system

Public Finance Management Act

The PFMA demands that accountability, transparency and good governance be reflected in all public sector financial management dealings (Government of Botswana 2011b). This Act prescribes the appointment of an Accountant General, a public officer entrusted with the custody and safety of public moneys, and its disbursement as well as the compilation and management of government accounts. The Act empowers the Auditor General to audit public accounts within six months of the close of each financial year. Although a proper records management regime is a critical element for the preparation of financial statements in organisations, as it facilitates the verification of the completeness and accuracy of data reported in the financial statements (Ngoepe 2012), Ngoepe and Ngulube (2013b:5) in a study that explored the role of records management in corporate governance in South Africa, found that the AGSA was not able to express an opinion on the financial statements primarily due to insufficient records.

Public Audit Act

The current PAA was initially part of the now defunct Finance and Audit Act of 1970 (Government of Botswana 1970) but it was replaced by the PAA (Government of Botswana 2012). The Finance and Audit Act also contained provisions now legislated in the PFMA (presented in detail in Section 2.2.3). Therefore, out of the provisions of the old Finance and Audit Act came the two laws: the PAA and the PFMA, separately.

The PAA provides for the Office of the Auditor General as established under the Constitution of the Republic of Botswana (Government of Botswana 2012) and outlines the duties of the Auditor General in terms of section 124(2) and (3) of the Constitution. These duties are to ensure that reasonable precautions are taken to safeguard the collection, receipt, issue, custody and disbursement of public monies and supplies, in accordance with applicable laws and instructions. This piece of legislation empowers the Auditor General to audit accounts and financial statements of public bodies as specified in the PFMA of 2011. In conducting the audits, the Auditor General must follow existing auditing standards, manuals or codes of ethics. Section 19(2a) of the PPA prescribes that the audit reports have to reflect at least an opinion or a conclusion on whether the annual financial statements of public bodies audited fairly present the financial position for the period covered by the audit.

CHAPTER ONE INTRODUCTION OF RESEARCH PROBLEM AND ITS CONTEXT

1.1 Introduction

1.2.1 Auditing in an Information Technology Environment

1.3 Contextual setting of the study

1.4 Statement of the Problem

1.5 Aim and Objectives of the Study

1.6 Research Questions

1.7 Conceptual Framework

1.8 Justification and Originality of the Study

1.9 Significance of The Study

1.10 Motivation for the Study

1.11 Scope and Delimitations of the Study

1.12 Definition of Key Terms

1.13 Research Methodology

1.14 Structure of the Thesis

1.15 Chapter Summary

CHAPTER TWO LITERATURE REVIEW

2.1 Introduction

2.2 The Legislative Framework for the Management of Digital Records

2.3 Maintaining the Authenticity of Records in Digital Systems

2.4 Capabilities and Competencies Required for Judging Authenticity of Digital Records

2.5 Management of Authentic Reliable Records in Information Systems

2.6 Summary

CHAPTER THREE RESEARCH METHODOLOGY

3.1 Introduction

3.2 Research Philosophy

3.3 Research Approach

3.4 Research Design

3.5 Study Population

3.6 Data Collection Instruments

3.7 Trustworthiness of Data Collection Instruments

3.8 Data Analysis and Presentation

3.9 Ethical Considerations

3.10 Evaluation of Research Methodology

3.11 Summary

CHAPTER FOUR PRESENTATION OF DATA FINDINGS

4.1 Introduction

4.2 Background of Participants

4.3 Data presentation

4.4 Study Recommendations

4.5 Summary

CHAPTER FIVE INTEPRETATION AND DISCUSSION OF FINDINGS

5.1 Introduction

5.2 Analysis of the Legislative Framework for Authentic Reliable Digital Records to Support Audit Processes

5.3 Procedures for the Creation and Maintenance of Authentic Digital Records

5.4 Skills and Competencies for Authenticating Digital Records

5.5 The Management of Authentic Digital Records to Support Audit Processes

5.6 Recommendations Offered by Study Participants

5.7 Summary

CHAPTER SIX SUMMARY OF STUDY FINDINGS, CONCLUSIONS AND RECOMENDATIONS

6.1 Introduction

6.2 Summary from the findings of the Study

6.3 Proposed Framework

6.4 Conclusions of the Study

6.5 Recommendations

6.6 Further Research

6.7 Implications on Theory and Practice

6.8 Final Conclusion

References

APPENDICES

GET THE COMPLETE PROJECT