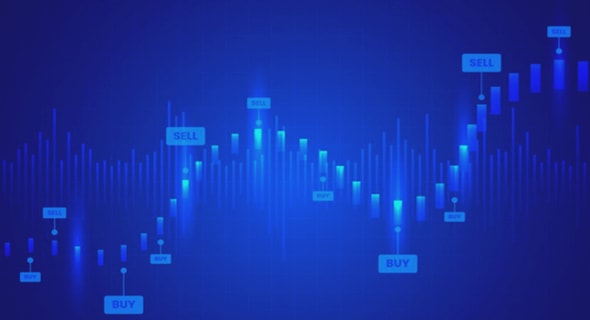

Trading en ligne, the trend line is one of the easiest and most powerful technical analysis tools and if you are able to draw it correctly it will be an important addition for you, there is an infinite number of strategies that build on trend lines, I will share with you in this article the best three streak strategies Direction can be used in trading.

Trend lines relate to classic technology analysis. Many traders add such lines to their strategy and use them not only on price charts but also on indicator charts.

We can say that the trend line is one of the simplest tools used for graphical analysis. At the same time, regardless of its simplicity, this tool is very effective.

Trend lines can show where to enter in the direction of a trend and where the current trend may end. The analysis of the price chart itself is a good feature: there is an opinion that the signals from the indicator are lagging, and the price is of particular interest.

However, we must bear in mind that all trading options must be customized, and different approaches must be tried to use both graphical analysis tools and indicator signals.

The rising trend line

An uptrend line is a line drawn across the lows from left to right. The second low should be higher than the first low. To draw the line, two points are sufficient.

Many authors refer to the third point as confirmation that the trend line has been drawn correctly. However, the moment the price hits the line, many traders are actually trying to buy, not waiting for confirmation.

As a rule, buying on a bounce off the trend line always occurs with a small stop loss, so the risk is not high. This is why most traders neglect the confirmation to some extent.

How to draw a trend line

In the beginning, keep in mind that the success of the strategy depends on a method of drawing the trend line in the correct way. To draw the trend line, two conditions must be met.

The trend line should be based on 3 points. You can always connect any 2 random points on your charts but only if you have a third point you are dealing with a correct trendline.

The trend line is based on the body of the candle

When drawing a trend line, it could cut the tail of the candle, but it is not acceptable for it to cross the body of the candle.

Trend Line Strategies

Fracture and re-test

The breakout and retest strategy is a very popular strategy used by many traders for its ease, and the idea is that once a trend line is identified, you wait for the price to break it down or down and then retest the trend line again

Sometimes the price runs away and does not re-test, it is not preferable to rush at this time and enter a trade,

One of the advantages of the trend line is that it provides you with clear points to stop loss, as a stop-loss order is generally placed below the trend line, and once this level is crossed, the trade, in this case, has failed and you should not re-enter again, that is, the trend line runs a protection level between Entry price and stop loss.

Determining the entry point varies depending on the nature of the trader, for example, an aggressive trader who is more risk-seeking will enter a trade as soon as the price comes back to test the trend line.

As for the more conservative trader, he does not enter into a trade until the price moves away from the trend line and shows momentum signals in the direction of the deal, and in this way, there may be a decrease in the profit margin, but in return, you will increase the success rate of the deal.

Rapid signals can be relied on to enter a trade, such as Japanese candlestick patterns.

Entry with the trend

The retest strategy that we explained above is considered a reversal strategy, and it is a good strategy that many traders follow, but what traders focus on most is to enter with the trend.

In this strategy, we are looking for a clear direction in the market, then waiting for a correction and drawing a trend line

If you have analyzed the prevailing trend and expected that the downtrend will resume, then you can enter directly after breaking the trend line, because you have analyzed the market before and you know that this is just a correction, in addition to the prevailing trend is the direction you are trading with.

As an example, let’s take a look at the trend line on the Litecoin chart. To draw it, we take two marginal bottoms and draw a line through them.

It is important to extend the line to the right so that we can see the moment of testing this line at the price. In our example, at the moment of testing the trend line, the price rebounds and continues to grow. We can say that the uptrend continues until the trend line is broken.

The falling trend line

A downtrend line is drawn by the upside. To plot it, we need two points on the graph, and the second point is less than the first.

Here, we should also remember that it is wise to wait for the third line to form and make sure that the bearish trend line is drawn correctly. In any case, it must be remembered that drawing trend lines is an art and therefore subjective.

This is the reason why different dealers can draw different lines that are important to them. The more experienced the trader, the better the drawing of lines.

How do you use trendlines?

The simplest method is to trade on a bounce off the trend line. In our example with an upward trend line on the Litecoin chart, at the moment of the third test, we could open a long position at around 67.00.

SL is in this case below 61.50. Profit-taking can be boldly placed above the previous high because the trend is up, and most likely prices will rise.

Alternatively, we can do without the TP position, moving the SL after the price. With this strategy, we do not limit the profit, we let it grow, which is what many experts in the technical analysis have recommended.

In the example of the AUD / USD pair, we should consider a short trade at the moment of another test of the trend line.