Get Complete Project Material File(s) Now! »

Flexible Accelerator Model

From the profit maximising neo-classical assumptions on the behaviour of a profit maximising firm, Hall and Jorgenson (1967, p.391) derived a function for investment with user-cost of capital as one of the determining factors. They incorporate postulations on a production function i.e. constant returns to scale, exogenously determined output and an adjustment mechanism of capital stock to derive a model that captures most of the relevant explanatory variables relating to an investment incentive and actual investment.

Tobin’s q theory

The alternative neo-classical theoretical approach linking investment incentives and actual investment as proposed by Jorgenson’s model is Tobin’s 1969 q theory. In the theory, q is defined as the ratio of market value of capital to its replacement cost. The q value determines incentive to invest (Hayashi, 1982, p.214). In other words, a profit maximising firm will always look at two factors when making an investment decision: how much value will the firm derive from investing an additional unit of capital and how much does it cost the firm to acquire that unit of capital. The theory introduces the cost of installing new investment in the firm’s optimisation decisions, thus, capturing the role of tax rules, investment tax credit and depreciation formulas, as these have a direct effect on cost of acquiring capital for investment vis-à-vis value to the firm derivable therefrom. Through specifying fiscal-investment incentive parameters in equation (2) and substituting accordingly in equation (1) the optimal investment level of a profit maximising firm can be influenced. For detailed derivation and specific solution(s), see Hayashi (1982, p.214-218). Both the Jorgensons’ and Tobin’s models come to the conclusion that the cost of capital has an influence on investment, and investment incentives are one of the factors that decrease the cost of capital. By offsetting the cost of capital investment, incentives can potentially increase investment, holding other factors constant. The fundamental difference between Jorgenson’s model and Tobin’s q theory model is that Jorgenson uses the capitallabour substitutability to introduce capital cost considerations. Tobin’s argument centres on firm benefit from invested capital. He introduces the cost of capital as being relevant to the investment decision, only to the extent that it influences the point where the marginal value of capital equates the marginal cost of capital.

Both the Jorgenson and Tobin’s q theory model are important in providing a theoretical foundation for the relationship between investment and investment incentives; however, the models do not specify conditions under which the relationship would take a particular form. All they say is that based on neo-classical economic assumptions, one can derive expressions linking investment and investment incentives, among many other factors. The models, however, set a foundation for empirical work of establishing how investment incentives (more so fiscal incentives) influence actual investment.

Fiscal investment incentives and investment: empirical studies

Investment incentives have been widely used as a tool to address industrial development in both developed and developing countries (Hall and Jorgenson, 1967, p.392; Bernstein, 1994, p.56; Bronzini & Blasio, 2006, p.237; Davies, 2005, p.500). Investment incentives often take the form of fiscal concessions hence the common interchangeable use of ‘investment incentives’ and ‘tax incentives’ phrases in the literature on the subject. The target for the incentives is often the attraction of foreign direct investment, the rationale being that many of the host countries or regions lack adequate capital to support their development agendas. Investment incentives lure mobile capital to a particular location by providing a signal to potential investors for favourable investment conditions (Raff and Srinvasan, 1998, p.168). Today, virtually all developing countries are using some form of incentives to attract direct investment (Hadari, 1990, p.121). The wide use of tax incentives to attract investment has led to a number of studies on merits of this offer and its impact on investment. Findings so far are mixed and inconclusive but nonetheless informative (Howell et al, 2002, p.1498; Tung & Cho, 2000, p.105).

Incentives as an effective tool for stimulating investment

Fumagalli (2003, p.964) argues that an offer of incentives facilitates efficient investment location decisions that would not otherwise have taken place without incentives in a particular place. His argument is supported by a number of empirical studies that concluded that the offer of investment incentives did influence investment (Bronzini & Blasio, 2006; Hall & Van Reenen, 2000; Tung & Cho, 2000; Head et al, 1999). Bronzini & Blasio (2006, p.328) used a descriptive statistical analysis to assess whether the offer of investment incentives to areas of the Italian manufacturing industry which lagged behind had a positive effect on investment. They found evidence that investment incentives did indeed bring forward investment projects in order to take advantage of available incentives. Such investment would not have taken place or could have potentially taken place at a later stage. With a similar intention of establishing a relation between offer of incentives and investment in a particular location, Tung and Cho (2000, p.105) used Chinese data to test the assertion that creation of special tax incentive zones was effective in inducing foreign investment into such areas. China provided an excellent opportunity to test incentiveinvestment relationships, as by 1993 the country had become the largest recipient of foreign investment despite its previous non-capitalistic economic strategy. Their regression analysis results showed that tax incentives were effective in attracting investment to China, and did influence the selection of a particular form of investment. Head et al (1999, p.197) studied Japanese investment in the USA between 1980 and 1992 to assess the effectiveness of investment promotion efforts of US states, using incentives. After controlling for agglomeration and fixed region effects, they found that incentives in the form of tax revenue and job-creation subsidies affected the location of investment. Unilateral withdrawal of investment incentives caused individual states to lose a substantial amount of Japanese investment. Still in the USA, Hall & Van Reenen (2000, p.449) found that the offer of tax incentives for R&D had a positive effect on actual R&D taking place, but not on investment in general, pointing to the fact it might be useful to disaggregate investment in assessing how incentives affect investment. The fact that incentives do not homogeneously influence all categories of capital was also observed by Feltenstein & Shah (1995, p.253). They examined the relative efficacy of using a tax instrument to promote private capital formation in Mexico. They found that corporate tax reduction had the most stimulative impact on investment. They however pointed out that if the intention of the incentive offering country is to encourage acquisition of state of the art technology, fiscal incentives may be ineffective as generic fiscal incentives increase the demand for both new and old capital. Proponents of incentives for investment cite the above and many more such studies to make their case. However, there are as many if not more empirical studies that conclude otherwise, as will be reviewed below.

1 INTRODUCTION

1.1 OVERVIEW OF THE SOUTH AFRICAN AUTOMOTIVE INDUSTRY

1.2 CHALLENGES FACING SOUTH AFRICAN AUTOMOTIVE INDUSTRY

1.3 RESEARCH LOGIC AND BROAD ISSUES FOR INVESTIGATION

1.4 SYNTHESIS

2 THE ADVENT AND PROSPECTS OF INVESTMENT INCENTIVES IN THE SOUTH AFRICAN AUTOMOTIVE INDUSTRY WITH REFERENCE TO COMPARABLE ECONOMIES

2.1 INTRODUCTION

2.2 THE MOTOR INDUSTRY DEVELOPMENT PROGRAMME (MIDP) OF THE SOUTH AFRICAN

AUTOMOTIVE INDUSTRY

2.3 TREND OF KEY INDUSTRY VARIABLES IN THE FIRST FIVE YEARS OF THE MIDP

2.4 THE PRODUCTIVE ASSET ALLOWANCE (PAA)

2.5 COMPARATIVE INTERNATIONAL EXPERIENCE ON AUTOMOTIVE INDUSTRY DEVELOPMENT POLICY

2.6 PROSPECTS OF THE PAA FOR THE SOUTH AFRICAN AUTOMOTIVE INDUSTRY

2.7 SYNTHESIS

3 TO GIVE OR NOT TO GIVE INCENTIVES TO SOUTH AFRICA’S AUTOMOTIVE INDUSTRY: A LITERATURE REVIEW

3.1 INTRODUCTION

3.2 INVESTMENT AND INVESTMENT INCENTIVES: THEORETICAL UNDERPINNINGS

3.3 FISCAL INVESTMENT INCENTIVES AND INVESTMENT: EMPIRICAL STUDIES

3.4 BENEFITS OF INVESTMENT

3.5 INCENTIVES IN THE SOUTH AFRICAN AUTOMOTIVE INDUSTRY

3.6 SYNTHESIS

4 THE PRODUCTIVE ASSET ALLOWANCE AND SOUTH AFRICAN AUTOMOTIVE INDUSTRY COMPETITIVENESS

4.1 INTRODUCTION

4.2 R&D INVESTMENT AND INDUSTRY COMPETITIVENESS

4.3 ECONOMIC THEORY ON R&D AND COMPETITIVENESS

4.4 NEED FOR LOCAL R&D AND TECHNOLOGICAL PROGRESS FOR THE SOUTH AFRICAN AUTOMOTIVE

INDUSTRY

4.5 INVESTMENT UNDER THE PAA

4.6 IMPACT OF THE PAA ON AN INDUSTRY PERFORMANCE

4.7 SYNTHESIS

5 METHODOLOGY AND RESEARCH DESIGN

5.1 METHODOLOGICAL CHOICE

5.2 SYSTEM DYNAMICS AND SYSTEM DYNAMICS METHODOLOGY

5.3 DATA COLLECTION

5.4 QUALITATIVE CONCEPTUALISATION OF MIDP INCENTIVES MODEL

5.5 SYNTHESIS

6 FORMALISATION OF THE PRODUCTIVE ASSET ALLOWANCE OF THE SOUTH AFRICAN AUTOMOTIVE INDUSTRY USING A SYSTEM DYNAMICS APPROACH

6.1 INTRODUCTION

6.2 CAUSAL LOOP DIAGRAMS OF THE MIDP INCENTIVES

6.3 THE MIDP INCENTIVE MODEL

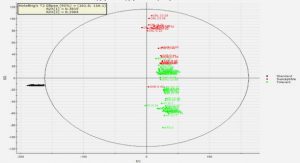

6.4 MODEL VALIDATION AND TESTING

6.5 MODEL SENSITIVITY TO EXOGENOUS VARIABLES

6.6 EXCHANGE RATES EFFECT ON INDUSTRY TRADE BALANCE

6.7 SYNTHESIS

7 PAA-IEC MODEL EXTENSION: INTRODUCTION OF THE DUTY FREE ALLOWANCE IMPORTS AND PRICE EFFECT ON EXPORTS

7.1 DUTY FREE ALLOWANCE

7.2 EXTENDED MODELS SIMULATIONS

7.3 SYNTHESIS

8 POLICY INSIGHTS

8.1 POLICY DECISIONS ON THE PAA

8.2 POLICY DECISIONS ON THE IMPORT-EXPORT COMPLEMENTATION

8.3 TIME-BOUND CONSTRAINTS OF THE PAA-IEC INCENTIVE DISPENSATION

8.4 COMPARISON IEC WITH THE PAA INCENTIVES

8.5 INDUSTRY PERFORMANCE WITHOUT THE IEC AND PAA INCENTIVES

8.6 SYNTHESIS

9.CONCLUSIONS

9.1 CLOSURE OF THE STUDY

9.2 THEORETICAL CONCLUSIONS

9.3 CONTRIBUTION TO PRIOR KNOWLEDGE

9.4 METHODOLOGICAL CONSIDERATIONS AND STUDY LIMITATIONS

9.5 AREAS FOR FURTHER RESEARCH

REFERENCES