Get Complete Project Material File(s) Now! »

Methodology

The authors would like to comment on more conceptual issues such as the data collection process, the research design, the time frame and the environment of the research conducted.

Descriptive research design

Cooper and Schindler (2011) define research design as the structure and framework of the research itself. The purpose and main focus of this research paper is to find a significant relationship between different micro- and macroeconomic variables and CEFs’ discount fluctuation. Hence it suits a more descriptive research design that is considered more eligible when studying statistical relationship between variables (Cooper & Schindler, 2011; Collis & Hussey, 2003). It refers to the collection and verification of quantitative data that solves a particular problem (Collis & Hussey, 2003). Here it is used to establish actualities that either support or reject the hypothesis on what variables causes CEFs’ discount to fluctuate (Cooper & Schindler, 2011).

Research and Data Settings

The authors would like to emphasize that the research undertaken here is perceived as deductive research. Collis and Hussey (2003) define deductive research as studies in which the theoretical structure first is developed and later tested. Tests can be done through the use of hypothesis and statistical techniques.

Quantitative research is preferably used when objectively monitoring and measuring different phenomena (Collis & Hussey, 2003). The use of quantitative research is preferred when a relationship between different dependent and independent variables needs to be tested. A common procedure is to gather numerical data for statistical examination (Collis & Hussey, 2003). Hence, this research can be considered as quantitative.

By employing a monitoring process (Cooper & Schindler, 2011), gathering of data will occur by observing and documenting frequencies of variables. A cross-sectional study refers to different contexts of variables, which are all collected during the same time frame (Collis & Hussey, 2003). This type of study is used when researchers need to reflect a current and continuing issue, in many times an economic one. Complementary to cross-sectional studies, more longitudinal studies will also be considered, in ordered to make more generalizations regarding the independent and dependent variables correlation over time. Cooper and Schindler highlight some other features that need to be taken under consideration when gathering data. When using statistical studies, much more concern is put on the generalization of the research, which can be effectively proven by significant results through statistical methods. This can be referred to the study’s scope.

Validity, Reliability and Generalizability

Validity refers to whether the result of this research paper does indeed reflect and capture the intended issue. Do the results seize the intended relationship between variables? Can these results be considered as uninfluenced by any researcher bias (Saunders, Lewis & Thornhill, 2007)? The generalizability, somewhat referred to as the research’s external validity, emphasizes whether the results of this research paper can be applicable in different research settings, such as using other samples or populations. The reliability of this research paper concerns whether the chosen techniques for sampling and analysis will generate reliable results.

Method

The authors would like to comment on more fundamental issues such as the dependent and independent variables used, the sampling process, the statistical methods used and formulas applied.

Sampling Process

The authors of this report have chosen a multi-staged sampling process. A multi-stage sampling process is normally used when a non-random sampling process is more suitable (Burton, Carrol & Wall, 1999). This sampling process has been divided into multiple steps. There are some common attributes between the subjects that the authors would like to include in the sample. Therefore, the non-random sample has been derived from a total population in multiple steps. The non-random sample then constituted the research’s sample frame, from which the authors then non-randomly selected the final sample.

The first step was to recognize the whole population of CEFs that is traded at NASDAQ OMX Stockholm. All companies with shares traded at Large-, Mid- and Small Cap and which are all represented in the sector Financials (Aktier – aktiekurser för bolag listade på NASDAQ OMX Nordic, 2012) were included in the first step. All shares traded at NASDAQ OMX Stockholm, Financial sector, constitute our sample frame (Collis & Hussey, 2003). The second step was to exclude all financial institutes or real estate conglomerates, which are not equivalent to the definition of a CEF, defined earlier in the text. As a third step, only CEFs that have their main investment interest and activities in Sweden are considered. Fourth, out of the 12 remaining Swedish CEFs, two were excluded because not fulfilling the data requirements (10 years of available data). 10 Swedish CEFs were to be included in the final sample.

Data gathering

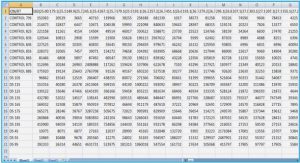

Time series analysis and cross-sectional studies will be conducted on the whole time frame of 10 years. The reason for this is that most CEFs in the chosen sample frame have not been quoted on the NASDAQ OMX Stockholm for a longer period (>10 years). Choosing a longer time frame would indeed decrease the sample frame, which would lead to less reliable and valid cross-sectional results. Thompson (1978) used yearly data between 1940-1975 and Pontiff (1995) used the same sample as Thompson did. In the article from 1997, Pontiff used the same sample as Lee et al. (1991) which represented 68 funds, using monthly data between 1965 -1985. All three studies are made on U.S. market. Although there is a small possibility to increase the time frame to more than 10 years, the authors have chosen to gather monthly and quarterly data in order to increase observations. Some of the data was not available at a monthly basis. In these cases, quarterly data have been duplicated to represent monthly data instead. Below is a table on what variables were computed and where the data was extracted. Important to acknowledge is that all variables except Jensen’s Alpha, Beta and the three measures of OMX Price Index have been lagged, in order to more accurately study investors reaction to information. By example, although the most 1st quarter interim reports provide information on the CEFs development and results between 1 January-31 March, the actual report is not available for the public until April. Therefore, the investors reaction on that information should not be possible to capture until the interim reports is made public. Hence, the mentioned variables data is lagged t+1 (One month).

Data Arrangement

The data measured in this report is to be considered as quantifiable, and is measured numerically (Saunders et al., 2007). In order to normalize the data gathered, the authors have computed the microeconomic variables as percentage ratios, using NAV or price per share. Normalization is done when data needs to be transformed into a common quantifiable value (Oxford Dictionary, 2012) to reduce any potential statistical errors.

Also, some consideration has been given on the potential existence of business cycle effects. Burns and Mitchell (1946) provides a definition of business cycles:

“Business cycles are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recurrent but not periodic.”

1 Introduction

1.1 Background

1.2 Problem Discussion

1.3 Research Question and Purpose

1.4 Definitions and Abbreviations

2 Suggested Previous Research

2.1 Thompson (1978)

2.2 Pontiff (1995)

2.3 Pontiff (1997)

3 Theoretical Framework

3.1 Theories on the origin of CEFs’ discount and its fluctuation from a micro perspective

3.2 Theories on the origin of CEFs’ discount and its fluctuation from a macro perspective

4 Hypothesis

5 Methodology

5.1 Descriptive research design

5.2 Method

5.3 Multiple Regression; OLS

6 Empirical Findings and Analysis

6.1 Raw Data

6.2 Mean Deviation Data

6.3 Analysis Discussion

7 Conclusion

7.1 Limitations

List of References

GET THE COMPLETE PROJECT

Investment Companies’ Discount Fluctuation on the Swedish Market A statistical analysis regarding different micro- and macroeconomic factors influence on Swedish closed-end funds’ discount